Uncategorized

What Makes HUAWEI FreeClip 2 the Best Open-Ear Earbuds Yet?

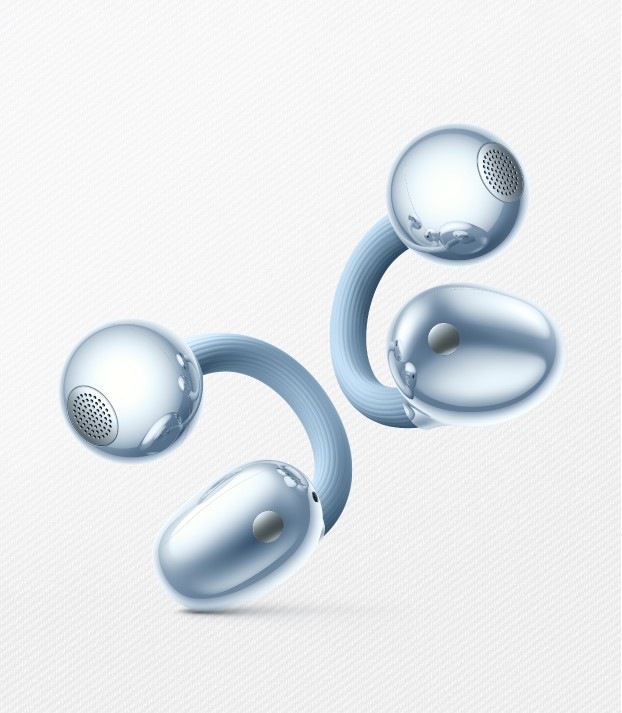

It has been two years since the debut of the original HUAWEI FreeClip, Huawei’s first-ever open earbuds that took the market by storm. Its massive popularity proved that the world was ready for a new kind of listening experience. The new HUAWEI FreeClip 2 tackles the hard challenges of open-ear acoustics physics head-on, combining a powerful dual-diaphragm driver with computational audio. It delivers depth and clarity, which was once thought impossible with an open-ear design. Solving the acoustic limitations of open-ear audio alone would have been sufficient to make the HUAWEI FreeClip 2 our pick for best open-ear audio.

But it is way more than that!

Comfortable C-Bridge design

The HUAWEI FreeClip 2 earbuds weigh only 5.1 g per bud, a 9% reduction from the previous generation. This lightweight architecture ensures an effortless experience, perfect for long calls, workouts, and commutes, allowing you to wear them all day without fatigue. The comfort bean is 11% smaller than the previous model, yet the design provides a secure fit that prevents the earbuds from falling out, even during intense activity.

Constructed from a new skin-friendly liquid silicone and a shape-memory alloy, the C-bridge is 25% softer and significantly more flexible than its predecessor. Finished with a fine, textured surface, it ensures a comfortable, irritation-free wearing even after extended use.

Adaptive open-ear listening

The acoustic system has been significantly upgraded, featuring a dual-diaphragm driver and a multi-mic call noise cancellation system. This setup not only delivers powerful sound but also maximises space efficiency. That’s why, despite their small size, these earbuds can deliver substantial acoustic performance.

The Open-fit design of the earbuds demands high computing power to maintain sound quality and call clarity. The HUAWEI FreeClip 2 offers ten times the processing power of the previous generation, serving as Huawei’s first earbuds to feature an NPU AI processor for a truly adaptive experience. The new dual-diaphragm driver includes a single dynamic driver with two diaphragms, effectively doubling the sound output within a compact space to provide a significant boost in volume and bass response.

Furthermore, the earbuds dynamically detect surrounding noise and adjust volume and voice levels in real-time. If the environment is too noisy, the system uses adaptive voice enhancement to specifically boost human frequencies, ensuring you never miss a word of a podcast or audiobook. When you return to a quiet environment, the earbuds automatically settle back to a comfortable volume level.

Crystal clear calls

To ensure call quality in chaotic environments, the HUAWEI FreeClip 2 utilises a three-mic system combined with multi-channel DNN (Deep Neural Network) noise cancellation algorithms. This system intelligently identifies and filters out ambient noise. Thanks to the NPU AI processor, the earbuds automatically enhance voice clarity, ensuring your conversations remain crisp regardless of your surroundings.

Battery life and charging

With the charging case, the HUAWEI FreeClip 2 offers a total battery life of 38 hours, allowing users to enjoy music throughout a full week of commuting on a single charge. On their own, the earbuds last for 9 hours—enough for a full workday of uninterrupted calls. For those in a rush, just 10 minutes of fast charging in the case provides up to 3 hours of playback. For added convenience, they support wireless charging and are compatible with watch chargers.

Rated IP57, the earbuds are resistant to sweat and water. They can easily withstand intense workouts or even a downpour.

Connectivity

The earbuds support dual connections and seamless auto-switching across iOS, Android, and Windows. When connected to EMUI devices, you can even switch audio between more than two devices. Additionally, when connected to a PC, the earbuds allow you to answer an incoming call without disconnecting from or interrupting your conference setup.

It is, quite simply, a pair of earphones reliable enough for the gym, the office, and the commute.

Home Integrator

SAGE Unveils Premium Eid Gifting Collection for Coffee Lovers

This Eid, Sage Appliances elevates gifting with high-performance coffee machines that combine precision, innovation, and refined design. Created for home hosts and coffee enthusiasts alike, each machine delivers barista-level results with ease, making it a gift that’s enjoyed well beyond the festive season.

Engineered around true duality, this machine empowers coffee lovers to seamlessly switch between intelligent automation and full manual control. Whether you prefer the ease of an automated workflow or the satisfaction of hands-on espresso craftsmanship, the Dual Boiler adapts to your style, delivering uncompromising performance, precision and flexibility in every cup.

Sage Barista Touch Impress Brass

Available in a striking limited-edition brass colourway, with limited stock available, this statement machine brings refined design to the forefront of the home coffee experience. The Barista Touch Impress blends intuitive automation with the freedom of hands-on control, making it effortless to craft café-quality favourites like flat whites, cappuccinos, and lattes with confidence and style.

This sleek, state-of-the-art machine delivers café-quality results with complete versatility from delicate pour-overs and bold filter coffee to smooth, flavour-rich cold brews. Featuring adjustable brew styles, temperature control and intuitive settings, it empowers users to take full control of their coffee, hot or cold.

Special Ramadan offer

Sage Appliance Accessories

For those who already own a Sage machine, accessories make a thoughtful gift this Eid, designed to enhance everyday use.

An automatically activated suction cup creates a rapid vacuum which quietly releases the espresso coffee puck from the portafilter in one swift action.

Thespring-loaded mechanism delivers consistent pressure between 7 kg and 10 kg, ensuring an even tamp every time. A variableforce gauge with marked indicators allows you to select your preferred tamp pressure to suit the grind. Available in 54 mm and 58 mm sizes.

The 2-in-1 distribution tool helps break up clumps and evenly spread coffee grounds. With three angled blades, it creates a level surface for consistent and precise tamping. Available in 54 mm and 58 mm.

Visually diagnose and troubleshoot your extraction to achieve the perfect pour every time with The Naked Porterfilter. Crafted from stainless steel with a walnut handle, it adds an elegant touch to your espresso setup while allowing you to monitor flow and consistency with precision. Available in both 54mm and 58mm sizes.

Handleless design and heat-resistant silicone sleeve gives full control, with a pro spout to create more precise latte art. Angled opening provides a better view when steaming milk.

Uncategorized

Majid Al Futtaim Malls Launch Ramadan Experiences Across the UAE

This Ramadan, Majid Al Futtaim, the leading shopping mall, communities, retail, and leisure pioneer across the Middle East, Africa, and Asia invites communities across the UAE to come together for a month filled with meaningful moments, exciting rewards, immersive activations and exclusive shopping offers all under one roof.

From grand prize draws and SHARE rewards to soulful Majlis evenings and community-led giving initiatives, here’s everything you won’t want to miss across Majid Al Futtaim malls this season.

SHARE the Rewards This Ramadan

Across all City Centre malls, customers using the SHARE App can enjoy generous points multipliers throughout the season. Whether you’re updating your wardrobe or gathering loved ones over iftar, every visit comes with more reasons to celebrate:

- Ramadan Offer: 10X points on F&B (Until 18 March)

- Eid Offer: 10X points on Fashion (12 to 22 March)

Letters of Giving (رسائل العطاء) at City Centre Mirdif and City and Mall of the Emirates

This Ramadan, Mall of the Emirates and City Centre Mirdif invite shoppers to take part in the Letters of Giving (رسائل العطاء) pop-up, a heartfelt initiative in partnership with Emirates Red Crescent dedicated to making children in need’s wishes come true.

Until 7 March at City Centre Mirdif and 9 March to 3 April at Mall of the Emirates, visitors are invited to pause, explore a display of children’s wishes, and choose one that speaks to them. They can then fulfil the wish by purchasing the item which will be gifted to the children in need. Each contribution will be accompanied by a personalized message typed on a traditional typewriter, turning every act of giving into a lasting gesture of kindness.

The Ramadan Experience at City Centre Mirdif and Mall of the Emirates

Until 7 March at City Centre Mirdif and 9 March to 3 April at Mall of the Emirates, the Majid Al Futtaim malls are blending art, generosity, and community, this pop-up offers an immersive and soulful experience. Guests can enjoy live harp, qanun, and cello performances featuring soft, Ramadan-inspired melodies, and visit interactive stations to personalize mirrors, bookmarks, or crafted coffee cups with a minimum mall spend of AED 150 (excluding Carrefour). Complementary juices, coffee, and mini bites invite visitors to connect and embrace the true spirit of Ramadan.

To elevate the experience, City Centre Mirdif is collaborating with Fatima Al Kaabi, an Emirati Entrepreneur to integrate AI‑powered displays showcasing traditional Emirati cultural quotes, adding a sense of heritage to the space.

Shop & Win: Ramadan at Mall of the Emirates (9 March to 3April)

This Ramadan, Mall of the Emirates introduces its very own “Shop & Win” reward. Guests who spend AED 300 or more at any of their favourite stores will automatically enter a special draw for a chance to win an exceptional grand prize of 500,000 SHARE points with one dedicated winner selected exclusively from Mall of the Emirates.

From exciting prizes and SHARE rewards to soulful gatherings and meaningful community initiatives, Ramadan at Majid Al Futtaim malls is all about creating moments that matter for everyone, every day.

Uncategorized

THE BIG CHILL CAFÉ INTRODUCES A COMFORT-DRIVEN IFTAR MENU THIS RAMADAN

This Ramadan, The Big Chill Café at Dubai Hills Mall invites guests to slow down, gather, and break their fast with a specially curated Iftar menu that blends comforting classics with generous portions and familiar flavours.

Designed for families, friends, and casual Ramadan catch-ups, the Iftar offering reflects The Big Chill Café’s signature style – wholesome, indulgent, and feel good – served in a relaxed café setting.

Guests can begin their meal with a selection of starters such as Minestrone Soup, Mediterranean Mezze with Hummus and Muhammara, Crispy Calamari, Chicken Tenders, or Panko-crumbed Prawns. The menu then moves into hearty mains, featuring crowd favourites including Penne Primavera, Creamy Mushroom Chicken Pasta, Saffron Risotto with Prawns, Hand-tossed Pizzas, and flavourful grill options.

For those looking to elevate their Iftar, the grill selection includes Grilled Chicken Breast, Slow-cooked Lamb Shank, Flame-grilled Steak with Cowboy Butter, and Tuscan-style Salmon, available with a small supplement.

To finish, The Big Chill Café turns up the indulgence with a dessert selection made for lingering over conversations. Guests can dive into the signature Molten Dubai Lava Cake with its rich and flowing centre, enjoy the comforting sweetness of Banoffee Pie, or opt for the fragrant Saffron Tres Leches Cake. Lighter yet nostalgic options like Date Ice Cream and crowd-favourite Biscoff Ice Cream round off the experience, offering something for every kind of sweet craving after Iftar.

Whether it’s a relaxed weekday Iftar or a long catch-up after prayers, The Big Chill Café’s Ramadan menu offers a warm and satisfying way to come together this holy month.

-

Tech News2 years ago

Tech News2 years agoDenodo Bolsters Executive Team by Hiring Christophe Culine as its Chief Revenue Officer

-

News10 years ago

SENDQUICK (TALARIAX) INTRODUCES SQOOPE – THE BREAKTHROUGH IN MOBILE MESSAGING

-

VAR11 months ago

VAR11 months agoMicrosoft Launches New Surface Copilot+ PCs for Business

-

Tech Interviews2 years ago

Tech Interviews2 years agoNavigating the Cybersecurity Landscape in Hybrid Work Environments

-

Tech News8 months ago

Tech News8 months agoNothing Launches flagship Nothing Phone (3) and Headphone (1) in theme with the Iconic Museum of the Future in Dubai

-

Automotive1 year ago

Automotive1 year agoAGMC Launches the RIDDARA RD6 High Performance Fully Electric 4×4 Pickup

-

VAR2 years ago

VAR2 years agoSamsung Galaxy Z Fold6 vs Google Pixel 9 Pro Fold: Clash Of The Folding Phenoms

-

Tech News2 years ago

Tech News2 years agoBrighton College Abu Dhabi and Brighton College Al Ain Donate 954 IT Devices in Support of ‘Donate Your Own Device’ Campaign