Tech Features

New Security Brief: Millions of Messages Distribute LockBit Black Ransomware

By Sarah Sabotka, Bryan Campbell, And The Proofpoint Threat Research Team

What happened

Beginning April 24, 2024, and continuing daily for about a week, Proofpoint observed high-volume campaigns with millions of messages facilitated by the Phorpiex botnet and delivering LockBit Black ransomware. This is the first time Proofpoint researchers have observed samples of LockBit Black ransomware (aka LockBit 3.0) being delivered via Phorpiex in such high volumes. The LockBit Black sample from this campaign was likely built from the LockBit builder that was leaked during the summer of 2023.

Messages were from “Jenny Green” with the email address of Jenny@gsd[.]com. The emails contained an attached ZIP file with an executable (.exe). This executable was observed downloading the LockBit Black payload from Phorpiex botnet infrastructure.

The emails targeted organizations in multiple verticals across the globe and appeared to be opportunistic versus specifically targeted. While the attack chain for this campaign was not necessarily complex in comparison to what has been observed on the cybercrime landscape so far in 2024, the high-volume nature of the messages and use of ransomware as a first-stage payload is notable.

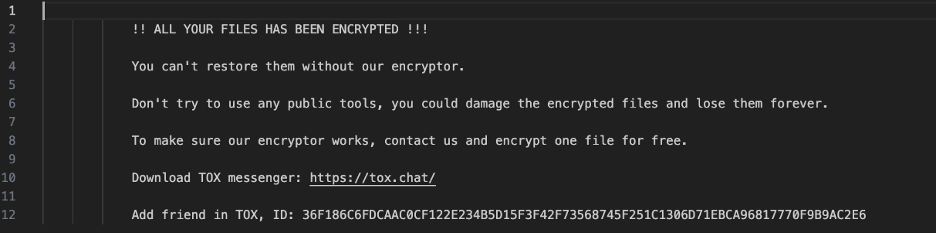

The attack chain requires user interaction and starts when an end user executes the compressed executable in the attached ZIP file. The .exe binary will initiate a network callout to Phorpiex botnet infrastructure. If successful, the LockBit Black sample is downloaded and detonated on the end user’s system, where it exhibits data theft behavior and seizes the system, encrypting files and terminating services. In an earlier campaign, the ransomware was directly executed, and no network activity was observed, preventing network detections or blocks.

Attribution

Proofpoint Threat Research has not attributed this campaign to a known threat actor. Phorpiex is a basic botnet designed to deliver malware via high-volume email campaigns. It operates as a Malware-as-a-Service and has garnered a large portfolio of threat actor customers over more than a decade of operation (earlier versions were first observed on the threat landscape circa 2011). Since 2018, the botnet has been observed conducting data exfiltration and ransomware delivery activities. Despite disruption efforts throughout the years, the botnet persists.

Proofpoint has observed a cluster of activity using the same “Jenny Green” alias with lures related to “Your Document” delivering Phorpiex malware in email campaigns since at least January 2023.

LockBit Black (aka LockBit 3.0) is a version of LockBit ransomware that was officially released with upgraded capabilities by the ransomware affiliates in June 2022. In September 2022, the confidential ransomware builder was leaked via Twitter. At the time, multiple parties claimed attribution, but LockBit affiliates claimed the builder was leaked by a disgruntled developer. The leak allows anyone to adopt the configuration for customized versions.

Why it matters

Ransomware as a first-stage payload attached to email threat campaigns is not something Proofpoint has observed in high volumes since before 2020, so the observation of a LockBit Black sample in email threat data on this global scale is highly unusual. Additionally, this campaign has been particularly notable due to the high volume of messages in the millions per day, volumes not commonly observed on the landscape. The number of messages and cadence associated with recently observed LockBit Black campaigns are at a volume not seen in malspam since Emotet campaigns.

The LockBit Black builder has provided threat actors with access to proprietary and sophisticated ransomware. The combination of this with the longstanding Phorpiex botnet amplifies the scale of such threat campaigns and increases chances of successful ransomware attacks. This campaign is another good example of how the threat landscape continues to change, underscored by recurring and significant shifts and pivots in the tactics, techniques, and procedures (TTPs) used by threat actors.

Tech Features

FROM COST EFFICIENCY TO CARBON EFFICIENCY: THE NEW METRIC DRIVING TECH DECISIONS

Ali Muzaffar, Assistant Editor at School of Mathematical and Computer Sciences, Heriot-Watt University Dubai

In boardrooms across the globe, something big is happening, quietly but decisively. Sustainability has evolved far beyond being a “nice-to-have” addition to an ESG report. It’s now front and centre in business strategy, especially in tech. From green computing and circular data centers to AI that optimizes energy use, companies are reshaping their technology roadmaps with sustainability as a core driver and not as an afterthought.

Not long ago, tech strategy was all about speed, uptime, and keeping costs per computation low. That mindset has evolved. Today, leaders are also asking tougher questions: How carbon-intensive is this system? How energy-efficient is it over time? What’s its full lifecycle impact? With climate pressure mounting and energy prices climbing, organisations that tie digital transformation to their institutional sustainability goals.

At its heart, green computing seeks to maximise computing performance while minimising environmental impact. This includes optimising hardware efficiency, reducing waste, and using smarter algorithms that require less energy.

A wave of recent research shows just how impactful this can be. Studies indicate that emerging green computing technologies can reduce energy consumption by 40–60% compared to traditional approaches. That’s not a marginal improvement, that’s transformational. It means smaller operating costs, longer hardware life, and a lower carbon footprint without sacrificing performance.

Part of this comes from smarter software. Techniques like green coding, which optimise algorithms to minimise redundant operations, have been shown to cut energy use by up to 20% in data processing tasks.

Organisations that adopt green computing strategies aren’t just doing good; they’re driving tangible results. Informed by sustainability principles, energy-efficient hardware and

optimisation frameworks can reduce energy bills and maintenance costs at the same time, often with payback periods of three to five years.

Data centres are the backbone of the digital economy. They power software, store vast troves of data, and support the artificial intelligence systems driving innovation. But this backbone comes with a heavy environmental load. Collectively, global data centres consume hundreds of terawatt-hours of electricity each year, which is about 2% of total global electricity.

As AI workloads surge and data storage demand explodes, energy consumption is rising sharply. Looking ahead to 2030, the numbers are hard to ignore. Global data

centre electricity demand is expected to almost double, reaching levels you’d normally associate with an entire industrialised country. That kind of energy appetite isn’t just a technical issue, it’s a strategic wake-up call for the entire industry.

This surge has forced a fundamental rethink of how data centres are built and run. Enter the idea of the circular data centre. It’s not just about better cooling or switching to renewables. Instead, it looks at the full lifecycle of infrastructure, from construction and daily operations to decommissioning, recycling, and reuse, so waste and inefficiency are designed out from the start.

The most forward-thinking operators are already implementing this approach. Advanced cooling methods, such as liquid cooling and AI-driven thermal management, are revolutionising the industry, reducing cooling energy consumption by up to 40% compared to traditional air-based systems. That’s a big win not only for energy bills, but also for long- term sustainability.

Beyond cooling, operators are turning heat waste into a resource. In Scandinavia, data centres are already repurposing excess thermal output to heat residential buildings, a real- world example of how technology can feed back into the community in a circular way. These strategies are already showing results, with approximately 60% of data centre energy now coming from renewable sources, and many operators are targeting 100% clean power by 2030.

Circular thinking extends to hardware too. Companies are designing servers and components for easier recycling, refurbishing retired equipment, and integrating modularity so that parts can be upgraded without replacing entire systems.

For businesses, circular data centres represent more than environmental responsibility. They can significantly lower capital expenditures over time and reduce regulatory risk as governments tighten emissions requirements. While AI itself has been criticised for energy use, the technology also offers some of the most effective tools for reducing overall consumption across tech infrastructure.

AI algorithms excel at predictive optimisation, they can analyse real-time sensor data to adjust cooling systems, balance computing loads, and shut down idle resources. Across case studies, such systems have reliably achieved 15–30% energy savings in energy management tasks in cloud environments, dynamic server allocation and AI-assisted workload management have contributed to energy savings of around 25% when compared with conventional operations.

Tech Features

THE YEAR AI WENT MAINSTREAM

Talal Shaikh, Associate Professor, Heriot-Watt University Dubai

In 2025, artificial intelligence crossed a threshold that had little to do with model size or benchmark scores. This was the year AI stopped feeling like a product and started behaving like infrastructure. It became embedded across work, education, government, media, and daily decision-making. The shift was subtle but decisive. AI moved from something people tried to something they assumed would be there.

From my position at Heriot-Watt University Dubai, what stood out most was not a single breakthrough, but a convergence. Multiple model ecosystems matured at the same time. Autonomy increased. Regulation caught up. Infrastructure scaled. And nations began to treat intelligence itself as a strategic asset.

From one AI story to many

For several years, public attention clustered around a small number of Western firms, most visibly OpenAI and Google. In 2025, that narrative fractured.

Google’s Gemini models became deeply embedded across search, productivity tools, Android, and enterprise workflows. Their strength lay not only in conversation, but in tight coupling with documents, spreadsheets, email, and live information. AI here was designed to live inside existing habits.

At the same time, Grok, developed by xAI, took a different path. With real-time access to public discourse and a deliberately opinionated tone, it reflected a broader shift in design philosophy. AI systems were no longer neutral interfaces. They carried values, styles, and assumptions shaped by their creators. That diversity itself was a sign of maturity.

By the end of 2025, users were no longer asking which model was best. They were choosing systems based on fit, trust, integration, and intent.

The rise of agentic AI

If generative AI defined earlier years, agentic AI defined 2025.

In 2023, most people experienced AI as a chatbot. You asked a question, it replied, and the interaction ended. In 2025, that interaction became continuous. An agent does not simply respond. It reads context, sets sub-goals, uses tools, checks results, and decides what to do next.

A chatbot drafts an email. An agent reads the full thread, looks up past conversations, drafts a response, schedules a meeting, and follows up if no reply arrives. A chatbot explains an error. An agent runs tests, fixes the issue, commits code, and opens a pull request.

This transition from response to agency turned AI from a helpful assistant into an operational participant. It also shifted risk. As systems gained the ability to act, questions of oversight, auditability, and failure containment moved from academic debate into everyday management.

A shift I saw first in the classroom

This change was not abstract for me. I saw it unfold directly in my classrooms.

Only a short time ago, many students dismissed AI-assisted coding with a familiar phrase: “It hallucinates.” They were not wrong. Early tools often produced code that looked correct but failed logically. Students learned quickly that blind trust led to wasted hours.

In 2025, that language faded.

Students now approach AI differently. They no longer ask whether the model is correct. They ask why it produced a solution, where it might fail, and how to constrain it. In one recent lab, a student debugging a robotics control pipeline did not reject the AI output after a failed test. He used it to generate alternative hypotheses, compared execution traces, and isolated the fault faster than traditional trial and error would allow.

At one point, a student stopped and said, “It is not hallucinating anymore. It is reasoning, but only if I reason with it.”

That sentence captures 2025 better than any benchmark.

From skepticism to supervision, in industry

The same shift is visible among our alumni now working in software engineering, fintech, data science, and robotics. Several who once warned juniors not to trust AI code now describe it as a first-pass collaborator. They use it to scaffold architectures, surface edge cases, and speed up documentation, while keeping final judgment firmly human.

The concern is no longer hallucination. It is over-reliance.

AI moved from being treated as an unreliable shortcut to being treated as a junior colleague, fast, useful, and fallible, requiring supervision rather than dismissal.

Sovereign AI, two models of power

One of the clearest signals that AI went mainstream in 2025 was the divergence in how regions approached it.

In much of the West, the year was framed as a corporate contest. Product launches, market share, and valuation battles dominated headlines. Innovation moved fast, driven by competition between private firms.

In the Middle East, and particularly in the UAE, the framing was different. AI was treated as national infrastructure.

The UAE’s investment in sovereign models such as Falcon and Jais reflected a belief that intelligence, like water or electricity, must be secured, governed, and trusted within borders. This was not about isolation. It was about resilience, data sovereignty, and long-term capacity. Dependence without control came to be seen as a strategic risk.

In 2025, this idea matured. Sovereign AI stopped being a slogan and became a planning principle. While the West debated which company would win, the UAE focused on ensuring that the capability itself remained accessible, accountable, and locally anchored.

When culture embraced AI

Another signal of mainstream adoption arrived from outside the technology sector.

The strategic alignment between The Walt Disney Company and OpenAI marked a moment when AI entered the core of global culture. Disney does not adopt technologies lightly. Its value lies in storytelling, world-building, and intellectual property sustained over decades.

This move was not about automating creativity. It was about scale and continuity. Modern story worlds span films, series, games, theme parks, and personalised digital experiences. Managing that complexity increasingly requires intelligent systems that can assist across writing, design, localisation, and audience interaction.

When a company whose primary asset is imagination treats AI as foundational, it signals that intelligent systems are no longer peripheral to creative industries. They are becoming part of how stories are built, maintained, and experienced. In that sense, 2025 marked the moment AI became cultural infrastructure, not just technical tooling.

Work changed quietly

Another sign of mainstreaming was how little drama accompanied adoption. Professionals stopped announcing that they were using AI. They simply expected it.

Developers assumed code assistance and automated testing. Analysts assumed rapid summaries and scenario modeling. Marketers assumed content generation and performance analysis. Students assumed access, but outcomes increasingly depended on how well they could guide, verify, and critique what AI produced.

This created a new divide. Not between technical and non-technical people, but between those who could reason with AI and those who delegated thinking to it.

What this means for universities

For universities, 2025 closed the door on treating AI as optional.

Every discipline now intersects with intelligent systems. Engineers must understand ethics and regulation. Business graduates must understand automation and decision support. Creative fields must grapple with authorship and originality. Researchers must design methods that remain valid when AI is part of the workflow.

At Heriot-Watt University Dubai, this pushes us toward assessment that rewards reasoning over polish, and education that teaches students not just to use AI, but to supervise it.

The real shift

AI went mainstream in 2025, not because it became smarter, but because society reorganised around it. Multiple models coexisted. Agents acted with growing autonomy. Nations planned for sovereignty. Culture adapted. Classrooms recalibrated trust.

The next phase will not be defined by faster models alone. It will be defined by judgment.

That is the quieter, more demanding challenge left to us after the year AI went mainstream.

Tech Features

FROM AI EXPERIMENTS TO EVERYDAY IMPACT: FIXING THE LAST-MILE PROBLEM

By Aashay Tattu, Senior AI Automation Engineer, IT Max Global

Over the last quarter, we’ve heard a version of the same question in nearly every client check-in: “Which AI use cases have actually made it into day-to-day operations?”

We’ve built strong pilots, including copilots in CRM and automations in the contact centre, but the hard part is making them survive change control, monitoring, access rules, and Monday morning volume.

The ‘last mile’ problem: why POCs don’t become products

The pattern is familiar: we pilot something promising, a few teams try it, and then everyone quietly slides back to the old workflow because the pilot never becomes the default.

Example 1:

We recently rolled out a pilot of an AI knowledge bot in Teams for a global client’s support organisation. During the demo, it answered policy questions and ‘how-to’ queries in seconds, pulling from SharePoint and internal wikis. In the first few months of limited production use, some teams adopted it enthusiastically and saw fewer repetitive tickets, but we quickly hit the realities of scale: no clear ownership for keeping content current, inconsistent access permissions across sites, and a compliance team that wanted tighter control over which sources the bot could search. The bot is now a trusted helper for a subset of curated content, yet the dream of a single, always-up-to-date ‘brain’ for the whole organisation remains just out of reach.

Example 2:

For a consumer brand, we built a web-based customer avatar that could greet visitors, answer FAQs, and guide them through product selection. Marketing loved the early prototypes because the avatar matched the brand perfectly and was demonstrated beautifully at the launch event. It now runs live on selected campaign pages and handles simple pre-purchase questions. However, moving it beyond a campaign means connecting to live stock and product data, keeping product answers in sync with the latest fact sheets, and baking consent into the journey (not bolting it on after). For now, the avatar is a real, working touchpoint, but still more of a branded experience than the always-on front line for customer service that the original deck imagined.

This is the ‘last mile’ problem of AI: the hard part isn’t intelligence – it’s operations. Identity and permissions, integration, content ownership, and the discipline to run the thing under a service-level agreement (SLA) are what decide whether a pilot becomes normal work. Real impact only happens when we deliberately weave AI into how we already deliver infrastructure, platforms and business apps.

That means:

- Embed AI where work happens, such as in ticketing, CRM, or Teams, and not in experimental side portals. This includes inside the tools that engineers, agents and salespeople use every day.

- Govern the sources of truth. Decide which data counts as the source of truth, who maintains it, and how we manage permissions across wikis, CRM and telemetry.

- Operate it like a core platform. It should be subject to the same expectations, such as security review, monitoring, resilience, and SLA, as core platforms.

- Close the loop by defining what engineers, service desk agents or salespeople do with AI outputs, how they override them, and how to capture feedback into our processes.

This less glamorous work is where the real value lies: turning a great demo into a dependable part of a project. It becomes a cross-functional effort, not an isolated AI project. That’s the shift we need to make; from “let’s try something cool with AI” to “let’s design and run a better end-to-end service, with AI as one of the components.”

From demos to dependable services

A simple sanity check for any AI idea is: would it survive a Monday morning? This means a full queue, escalations flying, permissions not lining up, and the business demanding an answer now. That’s the gap the stories above keep pointing to. AI usually doesn’t fall over because the model is ‘bad’. It falls over because it never becomes normal work, or in other words, something we can run at 2am, support under an SLA, and stand behind in an audit.

If we want AI work to become dependable (and billable), we should treat it like any other production service from day one: name an owner, lock the sources, define the fallback, and agree how we’ll measure success.

- Start with a real service problem, not a cool feature. Tie it to an SLA, a workflow step, or a customer journey moment.

- Design the last mile early. Where will it live? Is it in ticketing, CRM, Teams, or a portal? What data is it allowed to touch? What’s the fallback when it’s wrong?

- Make ownership explicit. Who owns the content, the integrations, and the change control after the pilot glow wears off?

- Build it with the people who’ll run it. Managed services, infra/PaaS, CRM/Power Platform, and security in the same conversation early – because production is where all the hidden requirements show up.

When we do these consistently, AI ideas stop living as side demos and start showing up as quiet improvements inside the services people already rely on – reliable, supportable, and actually used.

-

Tech News2 years ago

Tech News2 years agoDenodo Bolsters Executive Team by Hiring Christophe Culine as its Chief Revenue Officer

-

VAR10 months ago

VAR10 months agoMicrosoft Launches New Surface Copilot+ PCs for Business

-

Tech Interviews2 years ago

Tech Interviews2 years agoNavigating the Cybersecurity Landscape in Hybrid Work Environments

-

News10 years ago

SENDQUICK (TALARIAX) INTRODUCES SQOOPE – THE BREAKTHROUGH IN MOBILE MESSAGING

-

Tech News6 months ago

Tech News6 months agoNothing Launches flagship Nothing Phone (3) and Headphone (1) in theme with the Iconic Museum of the Future in Dubai

-

Tech News2 years ago

Tech News2 years agoBrighton College Abu Dhabi and Brighton College Al Ain Donate 954 IT Devices in Support of ‘Donate Your Own Device’ Campaign

-

VAR1 year ago

VAR1 year agoSamsung Galaxy Z Fold6 vs Google Pixel 9 Pro Fold: Clash Of The Folding Phenoms

-

Editorial1 year ago

Editorial1 year agoCelebrating UAE National Day: A Legacy of Leadership and Technological Innovation