Tech News

Cloudera Network Observability Expands with Taikun Acquisition

Cloudera Acquires Taikun to Deliver Cloud Experience to Data Anywhere for AI Everywhere

Cloudera has acquired Taikun, a leader in Kubernetes and cloud infrastructure management, to strengthen Cloudera’s network observability and deliver cloud-native AI and data services across any environment. This strategic move empowers enterprises to simplify deployment, enhance performance, and control complex hybrid ecosystems from a unified platform.

Why This Acquisition Matters

As businesses shift toward distributed architectures and AI-driven workloads, Cloudera’s latest acquisition offers a unified way to manage them. With Taikun’s native Kubernetes integration, Cloudera gains a scalable compute layer that streamlines deployment and operations. Now, enterprises can manage observability, analytics, and AI models on any platform—seamlessly.

This flexibility is especially critical in regulated industries and sovereign cloud environments, where infrastructure control is essential. Whether data resides in a secure data center or across multiple clouds, Cloudera network observability now supports it all.

Key Benefits for Enterprises

This acquisition brings four immediate advantages:

- Run AI Anywhere: From on-prem to hybrid and sovereign cloud, enterprises retain complete control over where workloads live.

- Lower Operational Risk: Zero-downtime upgrades and efficient resource allocation reduce infrastructure costs.

- Greater Ecosystem Support: Enterprises can easily integrate tools like Spark, Kafka, HBase, and third-party databases.

- Future-Proof Architecture: The platform adapts to evolving business needs without vendor lock-in.

By consolidating observability, performance, and AI capabilities into one platform, Cloudera ensures operational agility in complex environments.

Voices from Leadership

“By integrating Taikun’s platform, we remove operational barriers and unlock real-time AI action for our customers,” said Charles Sansbury, CEO of Cloudera.

“This is a turning point for our technology,” added Adam Skotnicky, former CEO of Taikun. “Together with Cloudera, we’ll deliver seamless data and AI services, no matter the environment.”

With Taikun’s engineering team joining Cloudera and forming a European R&D hub in the Czech Republic, the company also reinforces its global innovation strategy.

Aligning with the Future of AI & Observability

This is Cloudera’s third strategic acquisition in just over a year, following Verta’s operational AI platform and Octopai’s data lineage solution. Combined, these moves solidify Cloudera’s leadership in AI-powered network observability, helping organizations unify fragmented data strategies and scale AI with confidence.

According to analyst Sanjeev Mohan, “This acquisition allows organizations to run AI and analytics wherever their data lives—accelerating decisions and unlocking real-time responsiveness.”

About Cloudera

Cloudera is the only data and AI platform company that brings the cloud anywhere. Supporting 100x more data than cloud-only vendors, it empowers global enterprises to run analytics, GenAI, and observability tools across any environment securely. Learn more at cloudera.com.

If you’re interested in how cloud-native architectures are transforming data infrastructure, check out Leveraging Big Data Technologies for Enhanced Architecture.

Tech News

AI and Data Roles Drive Gulf Hiring Growth: RemotePass report

Hiring growth in the UAE and Saudi Arabia remains among the strongest globally, at 39% and 26% respectively in 2024–25, but the expansion is increasingly concentrated in a narrower set of roles, according to the RemotePass 2025 Hiring Report.

Data from the report shows outsized growth in specialised roles, with Data Scientist hiring up 43% and AI Product Manager demand rising 37%. The concentration of growth in these functions indicates that organisations are directing hiring investment toward specific capabilities rather than expanding uniformly across all technology roles.

This pattern reflects a shift in regional workforce strategy, with employers increasingly directing resources toward roles that support data-driven decision-making, AI deployment, and product execution, rather than scaling traditional technology teams.

AI and Data Roles Redefine Hiring Priorities

The UAE leads globally in AI hiring growth, rising from 32% in 2023–24 to 48% in 2024–25. The acceleration is among the sharpest recorded in any market and is being fuelled by enterprise AI adoption, fintech automation and large-scale digital infrastructure projects. Saudi Arabia shows a similar direction of travel, though at a steadier pace, as AI talent demand expands across both public and private sectors.

RemotePass Co-founder and CEO Kamal Reggad, said the data shows organisations in the UAE and Saudi Arabia moving decisively from experimentation to execution. AI is no longer confined to innovation teams, he noted, but is increasingly embedded into core business functions, making workforce planning a critical lever of competitiveness.

MENA Talent Hubs Continue to Power the GCC

While demand is strongest in the Gulf, the wider MENA region remains central to meeting it. Egypt continues to lead hiring volume across nearly every major tech role, including software engineering, backend, frontend, data science and QA, confirming its position as the region’s largest tech talent exporter. Pakistan ranks second across several engineering categories, supported by a large and cost-effective developer base.

Egypt’s AI hiring growth, after surging by 112% in the previous year, has stabilised at 28% in 2025. In contrast, Gulf markets have accelerated, reinforcing a regional realignment in which the UAE and Saudi Arabia are emerging as the primary centres of advanced technology hiring, supported by a broader MENA talent ecosystem.

Tech News

GCC RESIDENTIAL SMART SECURITY MARKET SET TO ADVANCE AS SCREENCHECK PARTNERS WITH BAS-IP

ScreenCheck, a subsidiary of Centena Group and a key player offering end-to-end identification and security solutions in the Middle East, has signed a strategic partnership agreement with global security technologies company, BAS-IP to officially expand its security and identification capabilities into GCC’s residential security market.

The agreement signed during Intersec 2026, aligns with ScreenCheck’s ongoing efforts to establish a robust position in the rapidly growing smart security and digital transformation market. Currently, the market is projected to reach USD 907.12 billion by 2032, growing at a compound annual growth rate of 25.7 per cent between 2025 and 2032. This growth is mainly propelled by large-scale urban development, smart infrastructure investments and surging demand for connected security ecosystems in the residential sector.

Olga Shamilova, Chief Executive Officer at BAS-IP, said: “We are delighted to partner with ScreenCheck and support their entry into this new vertical of security systems. During our participation at Intersec 2026, we witnessed increased interest for our Open API, especially for its ability to create seamless, customised ecosystems and ease to integrate into existing building management systems. Our mobile-first application also received significant attention, as its intuitive interface was proven ideal for both complex multi-apartment projects and luxury private villas. With ScreenCheck’s market expertise in the region and their top tier client base, we look forward to providing a safe and secure environment for communities.”

The collaboration with BAS-IP will address the surging demand from developers for connected home and community security solutions across apartments, gated communities and large residential developments in the region by delivering integrated IP-based audio and video intercom systems combined with access control solutions.

Faisal Mohamed, CEO of ScreenCheck, said: “As cities continue to develop and digital infrastructure becomes an inevitable part of everyday lives, security is equally important for people and systems. We are delighted to work with BAS-IP to serve this evolving market.”

“With the Middle East region experiencing one of the fastest-growing property markets across the globe, our collaboration helps to distribute integrated residential security and home automation solutions. We will be delivering cutting-edge biometric identification, RFID solutions, AI-powered surveillance, and next-generation smart access control to homes, critical infrastructure, and technology-driven enterprises. Our goal is to enable safer, more resilient spaces that highlight the capabilities of the modern security landscape,” added Faisal.

ScreenCheck’s partnership with BAS-IP positions the company at the forefront of the region’s ongoing shift, enabling the delivery of intelligent, connected residential security ecosystems that align with the region’s smart city ambitions and evolving urban landscape.

Tech News

VERTIV INTRODUCES NEW MODULAR LIQUID COOLING INFRASTRUCTURE SOLUTION TO SUPPORT HIGH-DENSITY COMPUTE REQUIREMENTS IN NORTH AMERICA AND EMEA

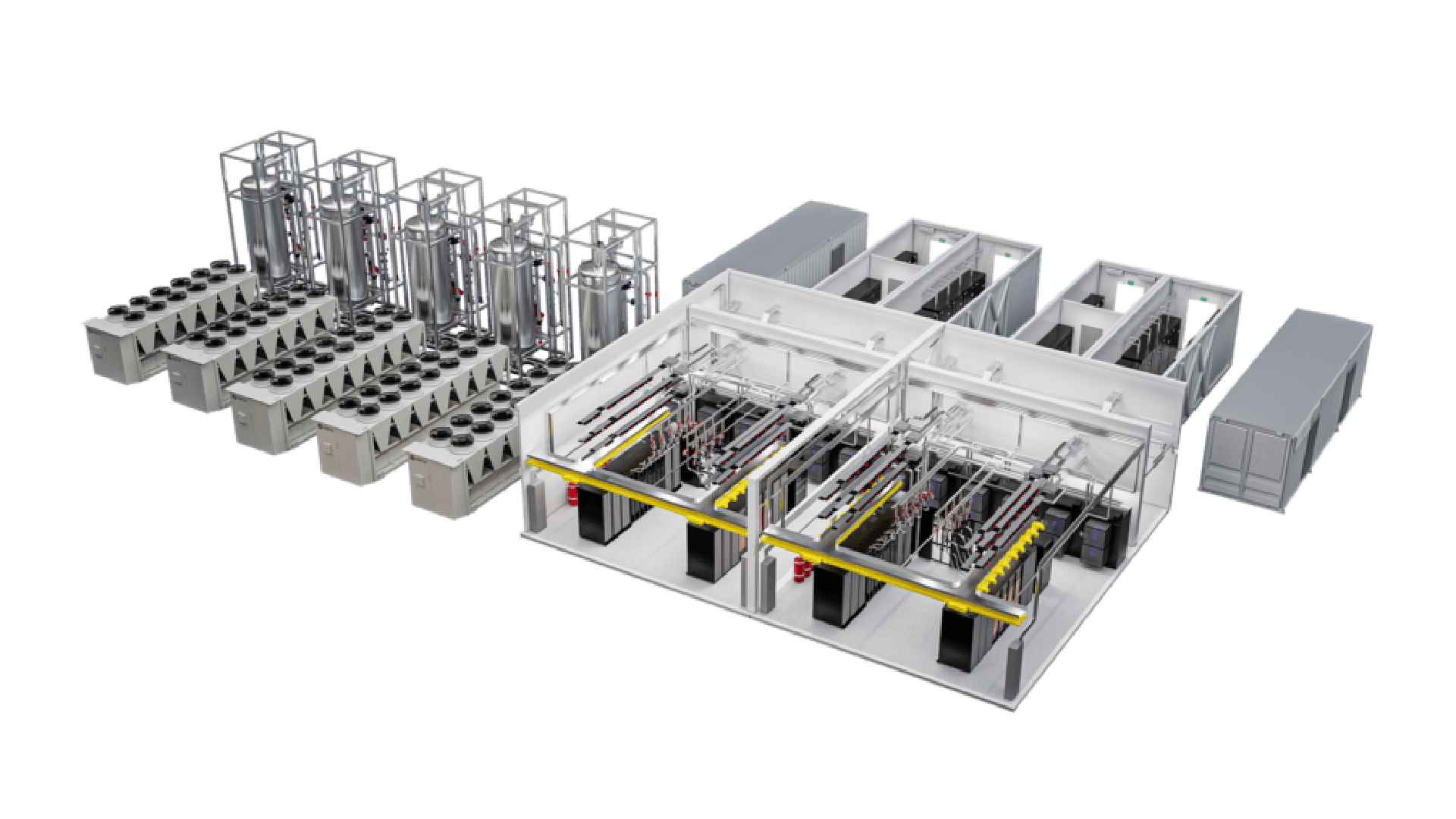

Vertiv (NYSE: VRT), a global leader in critical digital infrastructure, today announced new configurations of the Vertiv™ MegaMod™ HDX, a prefabricated power and liquid cooling infrastructure solution engineered for high-density computing environments, including artificial intelligence (AI) and high-performance computing (HPC) deployments. The new configurations give operators flexibility to support rapidly increasing power and cooling requirements while optimizing space and deployment speed. The models are available globally.

Vertiv MegaMod HDX integrates direct-to-chip liquid cooling with air-cooled architectures to meet the intense thermal demands of AI workloads, supporting pod-style AI environments and advanced GPU clusters. The new compact solution has a standard module height and a maximum of 13 racks and power capacity up to 1.25 MW; the combo solution has an extended-height design with a maximum of 144 racks, supporting power capacities up to 10 MW. Both can support rack densities from 50 kW up to more than 100 kW per rack. The hybrid cooling architectures integrate direct-to-chip liquid cooling with air cooling for efficient, high-density thermal management, while the prefabricated modular designs enable accelerated deployment and allow customers to scale their data centers as demand grows.

“Today’s AI workloads demand cooling solutions that go beyond traditional approaches. With the Vertiv MegaMod HDX available in both compact and combo solution configurations, organizations can match their facility requirements while supporting high-density, liquid-cooled environments at scale. Our designs deliver what data centers need most—reliable performance, operational efficiency, and the ability to scale their AI infrastructure with confidence,” said Viktor Petik, senior vice president, infrastructure solutions at Vertiv.

The Vertiv MegaMod HDX models feature innovative hybrid cooling architecture, combining direct-to-chip liquid cooling with adaptable air systems in a fully integrated, prefabricated pod. The solutions feature distributed redundant power architecture enabling continuous operation even if one module goes offline. Additionally, the buffer-tank thermal backup system allows GPU clusters to maintain stable operations during maintenance or load transitions. This factory-integrated design enables repeatable precision in deployment while providing cost certainty for planning and scaling AI infrastructure.

This prefabricated design, combined with factory integrated and fully tested components and Vertiv’s global service network, provide dependable end-to-end support.

Vertiv’s extensive portfolio of power, thermal, and IT management solutions supports a wide range of data center architectures, enabling customers to meet rising density demands with scalable, high-performance infrastructure. Both configurations draw on this broader portfolio, including the Vertiv™ Liebert® APM2 uninterruptible power supply (UPS), Vertiv™ CoolChip CDU cooling distribution unit, Vertiv™ PowerBar busway system, and Vertiv™ Unify infrastructure monitoring.

Vertiv also offers IT rack infrastructure designed to seamlessly accommodate and support IT systems, including Vertiv™ racks and Vertiv™ OCP- compliant racks, Vertiv™ CoolLoop RDHx rear door heat exchanger, Vertiv™ CoolChip in-rack CDU, Vertiv™ rack power distribution units, Vertiv™ PowerDirect in-rack DC power system, and Vertiv™ CoolChip Fluid Network Rack Manifolds.

-

Tech News2 years ago

Tech News2 years agoDenodo Bolsters Executive Team by Hiring Christophe Culine as its Chief Revenue Officer

-

VAR10 months ago

VAR10 months agoMicrosoft Launches New Surface Copilot+ PCs for Business

-

Tech Interviews2 years ago

Tech Interviews2 years agoNavigating the Cybersecurity Landscape in Hybrid Work Environments

-

News10 years ago

SENDQUICK (TALARIAX) INTRODUCES SQOOPE – THE BREAKTHROUGH IN MOBILE MESSAGING

-

Tech News7 months ago

Tech News7 months agoNothing Launches flagship Nothing Phone (3) and Headphone (1) in theme with the Iconic Museum of the Future in Dubai

-

Tech News2 years ago

Tech News2 years agoBrighton College Abu Dhabi and Brighton College Al Ain Donate 954 IT Devices in Support of ‘Donate Your Own Device’ Campaign

-

VAR1 year ago

VAR1 year agoSamsung Galaxy Z Fold6 vs Google Pixel 9 Pro Fold: Clash Of The Folding Phenoms

-

Editorial1 year ago

Editorial1 year agoCelebrating UAE National Day: A Legacy of Leadership and Technological Innovation