Automotive

Škoda’s Roadmap to Growth and Innovation in the Middle East

Exclusive Interview with Lukas Honzak, Managing Director at Škoda Middle East

What specific strategies have contributed to the 10% sales growth in the Middle East, and how do you plan to sustain this momentum?

Škoda’s 10% sales growth in the Middle East has been driven by a combination of its diverse product portfolio and nearly 130 years of European expertise, delivering quality and reliability that customers trust. From compact sedans to versatile SUVs, Škoda offers vehicles that cater to a broad range of demographics, ensuring there’s something for everyone. Furthermore, Škoda’s value-for-money proposition and competitive pricing have been crucial in attracting new customers and driving sales across the region.

In addition to its strong product line-up, Škoda has developed robust partnerships with local dealers, expanding its dealer network to improve accessibility and brand presence. By collaborating closely with partners and integrating Škoda’s core values, the company has achieved significant milestones, including the launch of a state-of-the-art, digital-first showroom in Kuwait. This expansion underscores Škoda’s strategic focus on the Middle East as a key region for growth.

The success has also been strengthened by ongoing support from Škoda’s global headquarters, which has provided strategic guidance and resources to ensure smooth operations and alignment with global standards. Recognising the Middle East as a high-potential market, Škoda remains committed to expanding the brand’s presence in the region, positioning it as a key area for long-term investment and growth.

Are there any upcoming model launches, facelifts, or generational changes planned for Škoda vehicles? How do these future releases align with the brand’s strategy for the Middle East?

Yes, Škoda has several exciting model launches and facelifts planned. In the final quarter of 2024, we will introduce refreshed versions of the Kamiq, Scala, and Karoq. At the beginning of 2025, we will launch our hero and top-selling model, the all-new Kodiaq, which has been a tremendous success in Europe, as well as the completely new Superb, our flagship limousine. Additionally, the Octavia, our best-selling model globally, will also receive a significant facelift.

2025 will be a remarkable year for Škoda Middle East, with a completely refreshed portfolio, showcasing new cars in new showrooms with our new corporate identity (CI). This is truly a unique moment for the brand, and we’re excited to present this new lineup to the region, where it’s bound to attract a lot of attention.

Furthermore, we are in discussions with Škoda HQ to bring additional new models to the region very soon, and we’re eager to share more details shortly. This sets 2025 up as a milestone year, with innovative products and expanded offerings that align with Škoda’s strategy to meet the evolving needs of customers in the Middle East.

Can you provide details on any new partnerships or business ventures Škoda is planning or has already secured in the Middle East? Are there specific markets or regions within the Middle East where these new collaborations or expansions are planned?

We are proud to have recently announced a key partnership with L’Étape Dubai by Tour de France. L’Étape Dubai is an amateur cycling event that brings the same quality and experience of the official Tour de France to the Middle East for the first time in February 2025.

Cycling is deeply embedded in Škoda’s brand identity, reflecting our commitment to promoting active lifestyles and community engagement. Our “We Love Cycling” platform exemplifies this ethos, and L’Étape Dubai by Tour de France is a significant part of this initiative. Škoda’s collaboration with the Dubai Sports Council for L’Étape highlights the importance of strategic partnerships with government bodies. This collaboration not only amplifies the event’s reach but also reinforces Škoda’s commitment to promoting health and fitness in the Middle East.

With the growing popularity of cycling in the region, we plan to expand our “We Love Cycling” platform across the Middle East, bringing cycling and sustainable mobility closer to our audience.

Could you share more about the most prominent dealerships and service centres in the UAE? How have they impacted, sales figures, customer experience and service accessibility?

Škoda’s prominent dealerships in the UAE, represented by Ali & Sons in Dubai, Abu Dhabi, and Al Ain, have played a crucial role in boosting sales and enhancing the overall customer experience. We offer customers a seamless buying process and top-tier after-sales support. This customer-centric approach has been a key contributor to Škoda’s sales growth in the region, with the UAE contributing over 56% of the overall Middle East sales year-to-date. The UAE has also experienced an average year-on-year sales growth of 46% since 2021, reflecting high levels of customer satisfaction and convenience.

Looking ahead, 2025 will see major investments in additional Škoda facilities in the UAE, underlining Ali & Sons’ long-term commitment to the brand’s growth. Early 2025 will witness the opening of a brand-new Škoda showroom in Abu Dhabi. In addition to new car sales, Ali & Sons will introduce the Certified Pre-Owned programme, Škoda Plus, in Q1 2025 to cater to a new audience, offering quality pre-owned vehicles with a risk-free experience.

Later in 2025, a state-of-the-art service centre and body shop dedicated to Škoda will open in Al Quoz, Dubai, as the largest Škoda service facility in the region. Additionally, Škoda will continue to bring its products closer to customers through roadshows, motor shows, and pop-up displays in strategic public locations, such as Mirdif City Centre and Dubai Festival City from 18th September to 18th October, where customers can experience our latest models and take test drives.

Furthermore, 2025 marks a significant year for Škoda’s regional growth as we expand into new markets, primarily to Oman and Saudi Arabia, completing our coverage of the entire GCC market. This expansion, along with our refreshed product portfolio and new facilities, will solidify Škoda’s presence across the Middle East, helping us fulfil our commitment to the region.

Could you provide insight into Škoda’s sales development in the Middle East and UAE, and the targets the brand aims to achieve by the end of the year?

Škoda’s market share in the Middle East has grown steadily, with a 10% increase in sales to date in 2024, driven by strong demand in key markets like the UAE and Kuwait. The Kodiaq and Kushaq models have been significant contributors to this success, reflecting the strength of our SUV lineup.

Looking ahead, 2025 is set to be a transformative year for Škoda, as we introduce a completely refreshed product portfolio, including the all-new Kodiaq and Superb, alongside major facelifts for the Octavia and Karoq. With these new models and our expansion into new markets, particularly Saudi Arabia, we expect to further boost our sales figures. While this year has been one of stabilisation and preparation for future growth, our refreshed portfolio and new market entries will position us for even greater success in 2025 and beyond.

Our focus on enhancing customer accessibility and service quality will remain central to our strategy as we aim to solidify our position in the Middle East with our broad range of SUVs and saloons.

Automotive

UDRIVE PARTNERS WITH AGMC TO INTRODUCE MINI VEHICLES TO ITS CAR-SHARING FLEET IN THE UAE

Udrive, the UAE’s leading car-sharing platform, has signed a strategic partnership with AGMC, the official importer of MINI in Dubai, Sharjah and the Northern Emirates, to introduce MINI vehicles to Udrive’s shared mobility fleet in the UAE. The collaboration was formalised through a Memorandum of Understanding (MoU) between Udrive and AGMC and brings the MINI brand — the iconic British-heritage premium automotive brand within the BMW Group, renowned for its distinctive design and engaging driving experience — into the car-sharing space, supporting a shared ambition to expand access to premium urban mobility solutions across the country.

The partnership will see a total of 100 MINI vehicles progressively introduced to the Udrive platform, with an initial fleet already available to customers across the UAE. The lineup will include MINI Convertibles, bringing the experience of open-top driving into the car-sharing space, alongside other MINI models well-suited to urban mobility and everyday city use. Through the Udrive platform, customers benefit from an all-inclusive car-sharing experience, with fuel and parking covered as part of the service.

By expanding flexible access to premium mobility, the partnership supports the UAE’s broader ambitions for smarter, more connected cities, in line with the vision outlined in the Dubai Master Urban Plan 2040. The collaboration reflects a growing shift toward agile, shared and experience-led mobility solutions, complementing evolving urban lifestyles and mobility needs.

Hasib Khan, Founder and CEO of Udrive, said: “At Udrive, innovation is about giving customers real choice and flexibility. Our platform is designed to adapt to how people live, whether that means enjoying a convertible over the weekend or choosing a practical vehicle during the week. Partnering with AGMC MINI allows us to bring distinctive premium vehicles to more customers and support the UAE’s vision for flexible and efficient urban mobility.”

Ziad Boghdady, Head of AGMC MINI, said: “Our collaboration with Udrive introduces a new way for customers to experience the MINI brand. Integrating MINI models into a car-sharing platform reflects changing preferences in the UAE, where access and flexibility are increasingly valued alongside design and performance, complementing MINI’s distinctive design and engaging driving experience. The partnership demonstrates AGMC MINI’s commitment to supporting modern mobility solutions that fit the needs of today’s urban lifestyles.”

Through the MoU, users will gain access to a range of MINI models via the Udrive platform, including Cooper S and John Cooper Works variants, as well as MINI Convertibles. Introducing convertibles into the car-sharing space expands the scope of shared mobility experiences, offering customers the opportunity to enjoy open-top driving on a flexible, on-demand basis.

Udrive enables customers to locate, book, and unlock vehicles through its mobile app, with flexible by-the-minute or by-the-day rentals. The service includes free fuel, free parking, and no deposit, removing common barriers associated with traditional car rentals. Udrive now operates a fleet of 2,000+ cars and has completed over three million rentals to date. In 2025 alone, the platform recorded over 554,000 trips and more than 45 million kilometres driven, reflecting growing demand for flexible mobility across the UAE.

Udrive continues to differentiate itself through exclusive partnerships, first-to-market initiatives, and value-led offerings that expand customer choice. Promoting car sharing as an alternative to private car ownership helps optimise vehicle usage, reduce congestion, and lower the overall environmental footprint by encouraging shared access over individual ownership.

Automotive

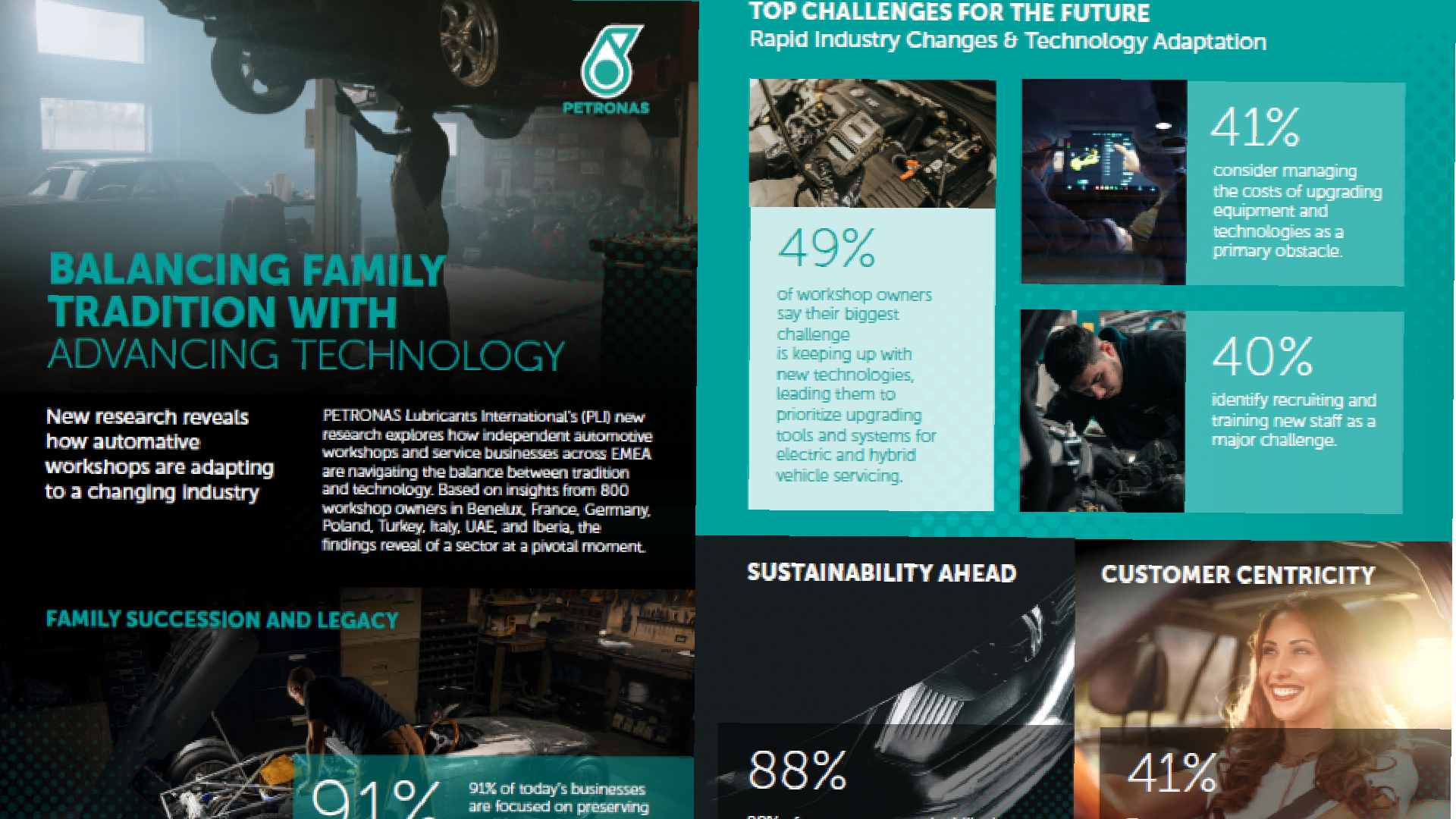

BALANCING TRADITION AND TECHNOLOGY: THE NEXT GENERATION TRANSFORMING AUTOMOTIVE WORKSHOPS

PETRONAS Lubricants International (PLI) today unveils new research exploring how independent automotive workshops and service businesses across EMEA are navigating the balance between tradition and technology. Based on insights from 800 workshop owners in Benelux, France, Germany, Poland, Turkey, Italy, the UAE, and Iberia, the findings reveal the sector is at a pivotal moment.

Nearly all workshop owners believe that protecting their reputation and values, as part of a family or community tradition, is paramount. This sense of legacy is particularly strong in Turkey (96%), the UAE (96%), and Iberia (95%.) The findings reveal a deep emotional connection among the next generation and new mechanics entering the industry, who are committed to preserving the skills and standards of their predecessors. Whilst at the same time, demonstrating the powerful blend of tradition and innovation which drives the sector.

The research, commissioned by PLI, reveals that owners are also acutely aware of the need to stay up to date with today’s technological advancements. This is where the energy and talent of younger generations become truly invaluable. Their passion for innovation and natural fluency with digital tools can transform what might seem like a challenge into an exciting new chapter for the industry. By actively investing in young talent and embracing their fresh perspectives, workshops can become vibrant hubs of progress, bridging digital and technological gaps, and leading the way in both the digital and green transitions shaping the automotive sector.

Nearly three in five (59%) owners report their workshop is seen as a trusted service provider locally but tradition alone isn’t enough to secure the future. With the industry changing fast, almost half (49%) of workshop owners say their biggest challenge is keeping up with new technologies. From electric and hybrid vehicles to digital systems and advanced diagnostics, the pressure to modernize is real. It’s also compounded by the struggle to find and train skilled staff, an issue flagged by nearly half of respondents (40%). For younger professionals entering the industry, this gap represents an opportunity to carve out a future in a sector hungry for fresh talent and innovation. Embracing the tech savviness and adaptability of younger workshop owners not only bridges existing gaps but also opens doors for further training and job opportunities, empowering workshops to evolve, driving a better future for all.

Despite the challenges of staffing, there’s a strong sense of optimism in the sector. Owners are determined to blend the best of the past with the demands of the future. More than a third (35%) say that putting the customer first remains their top priority, even as they navigate new territory. They’re finding ways to balance tradition with innovation, ensuring their workshops stay relevant and resilient.

“Independent workshops are the backbone of the automotive industry, and their ability to evolve by bringing in younger generations is inspiring. The research that PLI has commissioned shows that while heritage and trust remain at the heart of these businesses, owners are embracing innovation, from electric vehicles to digital tools and sustainable practices. At PLI, we’re committed to supporting this transformation by providing solutions that help workshops stay competitive, relevant, and true to their values.” said Giuseppe Pedretti, Regional Managing Director EMEA, PETRONAS Lubricants International

Sustainability is a defining theme for the sector, with nearly nine in ten (88%) workshop owners considering it essential in daily operations and customer communications. As consumers become more environmentally conscious, integrating sustainable practices is crucial for long-term growth, reputation, and alignment with global goals. Accelerating this transition requires investing in younger workshop owners, who bring fresh perspectives, digital expertise, and enthusiasm for innovation, supported by targeted training.

Empowering the next generation goes beyond adapting to change; it ignites a shared passion for the future and ensures workshops remain central to a dynamic, evolving industry. As the automotive landscape transforms, PLI stands as a trusted partner, offering solutions that reflect the values and ambitions of both established owners and emerging talent, driving real-world success.

Automotive

HOW FAR CAN AI DRIVE THE AUTOMOTIVE SECTOR?

Co-authored by: Giuseppe Pedretti (Regional Managing Director EMEA, PLI) & Ravi Tallamraju (Chief Technology Officer, PLI)

The conversations around AI in the automotive industry are often associated with self-driving cars. Yet, it’s the behind-the-scenes applications of AI, from design and diagnostics to driver experience and operational strategy, that are proving to be far more transformative.

Predictive maintenance has emerged as one of AI’s most powerful contributions to the sector. By continuously analysing telematic and operational data, AI enables early detection of mechanical stressors and anticipates component failures before they escalate. This foresight empowers fleet managers and workshops to schedule interventions with precision, minimising service interruptions, extending vehicle longevity, and curbing unnecessary expenditure.

AI-driven maintenance strategies are reshaping operational resilience, providing benefits such as real-time issues diagnosis, automated service reminders, and refined route efficiency, In fact, over half of fleet managers cite predictive analytics as a key lever for reducing overheads and enhancing performance, with nearly a third identifying AI and machine learning as the most influential technologies in fleet management over the next five years. From voice-enabled assistants that coach drivers to connected cameras that detect fatigue, the scope of predictive tools is expanding and ushering in a new era of intelligent, preventative care across the mobility landscape.

These innovations are especially critical for a sector that has faced considerable turbulence. In 2024, the automotive industry grappled with factory closures, supply chain fragmentation, and declining production across Europe and the West. Consumer demand softened under affordability pressures, while rising component costs and inflation compressed margins across the value chain, from workshops to fleet operators. Meanwhile, intensifying competition from Chinese manufacturers continues to push Western businesses to innovate and streamline.

Some argue AI has contributed to these pressures, but is also key to overcoming them. Its ability to convert data into strategic insights and automate complex workflows is helping businesses regain competitiveness, uncover new revenue streams, and reimagine their operating models.

Shifting Gears with AI

By 2032, the global automotive AI market is projected to reach $405 billion, with roughly 75% of automotive enterprises experimenting with at least one GenAI application. While major players are deploying AI across product design, supply chain optimisation, and customer engagement, fast accelerating smaller businesses stand to gain the most.

For these companies, the focus is on enhancing practical tools that drive measurable efficiency. Vehicle telematics, for example, enables workshops to diagnose issues in real time, store service histories, and anticipate future maintenance needs. This reduces reactive repairs and improves outcomes for customers and stakeholders alike.

Another area gaining traction is inventory intelligence. AI-powered forecasting tools analyse historical and repair data to predict parts demand with increasing accuracy. This not only prevents overstocking but ensures critical components are available when needed.

Fleet managers are equally enthusiastic as AI helps maintain uptime, optimise routes, and improve safety. Generative AI is powering in-vehicle voice assistants that guide drivers, flag risky behaviour, and even offer coaching. Connected cameras now detect signs of fatigue or distraction, reducing risk exposure and potential legal liabilities.

In-car connected services are also surging, with adoption expected to grow from 60% in 2024 to over 90% of new vehicles featuring voice assistants by 2028.

Why AI Belongs in Automotive Operations

The numbers speak volumes: the global market for automotive AI is forecasted to grow from $44 billion in 2025 to $74.5 billion by 2030. But beyond the figures, the rationale is clear.

Efficiency is a key driver of change. AI automates routine diagnostics, speeds up service checks, and simplifies documentation – allowing skilled personnel to focus on higher-value tasks. At the same time, these intelligent systems continue to learn and improve over time.

Safety is equally critical. Traditionally, the industry has taken a reactive approach, fixing problems only after they occur. AI transforms this model by enabling proactive vehicle management by detecting potential risks early, preventing failures, and ensuring compliance with increasingly strict safety regulations.

Cost control remains a key priority. In a margin-sensitive industry, even minor delays or downtime can erode profitability. AI helps minimise idle time, identify inefficient driving behaviours, and deliver more precise diagnostics. With fuel costs accounting for up to 40% of fleet expenses, AI plays a crucial role in pinpointing and eliminating waste, leading to more reliable operations and healthier bottom lines.

Still, adoption isn’t universal. Complex tools, fragmented data, and constrained budgets pose real challenges, especially for smaller players who rely more on experience than analytics. That’s precisely where AI excels: transforming existing knowledge into actionable intelligence.

How PETRONAS Lubricants International Uses AI

As a lubricant specialist, PETRONAS Lubricants International (PLI) leverages AI to accelerate R&D. Our models simulate lubricant performance under varied operating conditions, trained on extensive datasets of compositions. This allows us to predict outcomes before physical testing, sometimes revealing unexpected applications beyond automotive.

Smart tech and IoT devices also enable us to forecast lubricant degradation and advise customers on optimal service timing. Our Oil Condition Monitoring (OCM) system analyses samples for contaminants and wear metals, identifying potential issues before they become costly failures. Expert technicians deliver tailored reports that guide oil drain intervals and ensure consistent performance across fleets and machinery. This proactive approach enhances efficiency and extends equipment lifespan through intelligent, data-backed insights.

Internally, AI supports our production health: minimising waste, optimising throughput, and helping us meet sustainability goals by avoiding unnecessary downtime.

What More Can AI Do?

The potential of AI in automotive services is just beginning to unfold. The innovations we have achieved in lubricants alone demonstrate what is possible. As data becomes more accessible and algorithms more refined, even small operations will compete on insight, not just infrastructure. And as those innovations ripple across the sector, the competitive landscape will shift. That shift is coming. Best to be ready and in a position to lead.

-

Tech News2 years ago

Tech News2 years agoDenodo Bolsters Executive Team by Hiring Christophe Culine as its Chief Revenue Officer

-

VAR10 months ago

VAR10 months agoMicrosoft Launches New Surface Copilot+ PCs for Business

-

News10 years ago

SENDQUICK (TALARIAX) INTRODUCES SQOOPE – THE BREAKTHROUGH IN MOBILE MESSAGING

-

Tech Interviews2 years ago

Tech Interviews2 years agoNavigating the Cybersecurity Landscape in Hybrid Work Environments

-

Tech News7 months ago

Tech News7 months agoNothing Launches flagship Nothing Phone (3) and Headphone (1) in theme with the Iconic Museum of the Future in Dubai

-

VAR1 year ago

VAR1 year agoSamsung Galaxy Z Fold6 vs Google Pixel 9 Pro Fold: Clash Of The Folding Phenoms

-

Tech News2 years ago

Tech News2 years agoBrighton College Abu Dhabi and Brighton College Al Ain Donate 954 IT Devices in Support of ‘Donate Your Own Device’ Campaign

-

Automotive1 year ago

Automotive1 year agoAGMC Launches the RIDDARA RD6 High Performance Fully Electric 4×4 Pickup