Financial

Redefining Business Interruption Insurance for Bitcoin Miners

Exclusive interview with Claire Davey, Head of Product Innovation & Emerging Risk, RELM

Relm Insurance, a leading specialty insurer for emerging and innovative sectors, has announced the launch of BTC Business Interruption Insurance (BTC BI), the first-ever Bitcoin-denominated business interruption coverage tailored specifically for Bitcoin miners. Unlike traditional policies, BTC BI eliminates currency conversion risks by aligning directly with miners’ revenue streams. It uses hashprice, a real-time metric based on mining economics, to accurately calculate losses and ensure fair compensation, providing miners with coverage that truly reflects their operational realities.

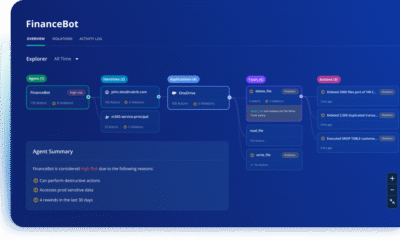

How AI Can Elevate Blockchain Security to New Heights?

The key difference is that the BTC BI is entirely denominated in Bitcoin. For miners, this is a game-changer. They earn revenue in Bitcoin, so having insurance coverage in the same currency eliminates the complexities and risks associated with currency conversion. Traditional insurers typically offer policies in fiat currency, which can misalign coverage with actual losses and expose miners to exchange rate volatility.

By denominating limits, premiums, and claims in Bitcoin we’re aligning our policies directly with miners’ revenue streams. This alignment provides stability in a volatile market and ensures that, in the event of a claim, miners receive compensation that truly reflects their operational losses. It removes the uncertainty of fluctuating currency values, allowing miners to focus on what they do best — power the digital economy.

Another standout feature is how we calculate loss of revenue. We use each miner’s hashprice, a metric that measures revenue per unit of computing power. This approach means any payout is based on real-time mining economics and ensures fair and accurate compensation.

Traditional policies often rely on generalized metrics or historical financial data that don’t capture the nuances of mining operations. Mining profitability can change rapidly due to factors like network difficulty, hash rate, and Bitcoin’s market price. By tying our calculations to the hashprice, we’re directly reflecting the miner’s actual earning potential at the time of the interruption.

This tailored method acknowledges that no two mining operations are the same. Whether a miner is operating a large-scale facility with the latest ASICs or a smaller setup with different equipment, our coverage adapts to their specific situation. It provides a safety net that’s as dynamic and responsive as the industry itself.

Can you elaborate on the technical underwriting expertise that Relm brings to the Bitcoin mining sector?

Absolutely. Our underwriting team, led by experts like George Frith , is deeply embedded in the Bitcoin mining community. George and his team maintain ongoing dialogues with miners and their broking partners to truly understand the exposures and challenges they face.

Claire Davey, Head of Product Innovation and Emerging Risk, puts it best:

“We’re not just insurers sitting behind desks — we’re partners invested in our clients’ success. By engaging directly with miners, we gain insights that allow us to craft policies that genuinely meet their needs. We visit mining sites, attend industry conferences, and stay up to date with the latest technological advancements. This hands-on approach enables us to anticipate risks rather than just react to them.”

Our team’s expertise spans the technical aspects of mining hardware, software, and operations. We understand the critical importance of uptime, the impact of energy costs, and the nuances of regulatory environments across different jurisdictions. This deep knowledge allows us to assess risks with precision and offer coverage that truly reflects the realities of mining.

Moreover, our proactive engagement means we’re aware of emerging trends before they become mainstream. Whether it’s the shift towards renewable energy sources, advancements in mining equipment efficiency, or changes in network protocols, we’re positioned to adjust our offerings accordingly.

By staying at the frontier of industry developments, we ensure that our clients are not only protected against current risks but prepared for future challenges. This level of commitment and expertise is what sets us apart in the insurance sector.

What prompted Relm to develop BTC Business Interruption Insurance specifically for Bitcoin miners?

Bitcoin miners have been underserved by the traditional insurance market for too long. Many insurers lack appetite for this space due to unfamiliarity or scepticism about cryptocurrency. There’s a perception that the crypto industry is too volatile or complex, which has led to a lack of suitable insurance products for miners.

Even those willing to offer coverage often can’t denominate policies in Bitcoin, creating a disconnect with how miners operate. This mismatch can lead to complications when filing claims and can expose miners to unnecessary financial risks due to currency fluctuations.

Miners face unique challenges that traditional insurers just haven’t addressed. For one, there’s the massive energy demand. Mining operations require a lot of power, making them vulnerable to power outages and spikes in energy prices. Then there’s the equipment itself. The hardware miners use is highly specialized and prone to damage and obsolescence over time, adding a layer of risk. Finally, there’s market volatility. Bitcoin’s value regularly dips and soars, greatly impacting miners’ revenue streams and operational stability. With BTC BI, we have addressed these specific pain points, offering a solution that wholly aligns with miners’ needs.

By launching BTC BI, we’re not just providing insurance; we’re empowering miners to innovate without the burden of unmanaged risk. We believe in the future of cryptocurrency and the vital role miners play in the digital economy.

As Claire notes:

“Bitcoin miners are at the forefront of a financial revolution and they deserve an insurance solution that recognizes and supports their vital role in the digital economy. We developed BTC BI to be that solution — a policy that speaks their language and meets their specific needs.”

What kinds of clients and partnerships does Relm engage with across its specialty industries?

We specialize in supporting clients from emerging sectors with innovative business models, and Bitcoin mining is a prime example.

Our clientele includes:

● Publicly Traded Miners

Large-scale operations with significant infrastructure and investment.

● Private Miners

Independent operations that may be scaling up or focusing on niche markets.

● Off-Grid Miners

Innovative setups utilizing renewable energy sources or operating in remote locations to optimize costs and efficiency.

Each client has unique needs, and we pride ourselves on offering customized solutions that address their specific challenges. We don’t believe in a one-size-fits-all approach. Instead, we tailor our policies to fit the operational realities of each miner.

We also cultivate strategic partnerships with brokers who specialize in emerging risks. These brokers understand the nuances of the industries we serve and help us stay connected to the evolving needs of our clients. Their expertise is invaluable in crafting policies that are both comprehensive and flexible.

Additionally, we collaborate with Web3 technology firms that enhance our risk management capabilities. By integrating cutting-edge tech solutions, we’re able to improve risk assessment by using advanced analytics and blockchain data that allows us to evaluate exposures with greater accuracy. With real-time monitoring tools, we proactively identify and address potential issues before they become significant, providing a more robust layer of risk mitigation for our clients.

These collaborations allow us to offer more than just insurance, they enable us to provide a suite of services that support our clients’ operational efficiency and strategic goals. We’re helping industries grow and become stronger.

Financial

Bridging Global Finance and Regional Demand in the UAE

With a strategic foothold in the UAE, global financial players are tailoring platforms, Sharia-compliant solutions, and tech-driven experiences to meet the region’s evolving trading demands.

Exclusive interview with Pavel Spirin, CEO, Scope Markets

Scope Markets is planning to expand into the UAE. What strategic importance does this region hold for your global operations?

The UAE plays a key role in our global strategy. While the population may be relatively small at around 10 million, the country is a gateway into the wider MENA region, where we see strong and growing demand for financial services. We’ve already received provisional approval from the Securities and Commodities Authority and are in the final stages of securing our full license. This market allows us to bring decision-making closer to our regional clients and establish a meaningful presence in a fast-growing financial hub.

How is Scope Markets differentiating itself in the highly competitive UAE financial services and trading space?

We’re focused on building products and experiences that genuinely reflect what clients here want. That means offering Sharia-compliant and swap-free account options, streamlining transactions to ensure instant deposits and withdrawals, and optimizing our platforms for mobile use. We’re also committed to being fully licensed and regulated in the UAE, which we believe is essential for building trust. Ultimately, our goal is to provide a responsive and tech-forward experience tailored to the unique needs of traders in this region.

What has been your experience working within the UAE’s regulatory frameworks, and how do you view the country’s role as a global financial hub?

Our experience with the Securities and Commodities Authority has been very constructive. The regulatory process is clear and well-structured, which gives firms like ours confidence in long-term planning. We’re currently finalizing our licensing and taking the required regulatory exams. What stands out to us is how fast the UAE has developed its financial infrastructure. It’s building frameworks for crypto, fintech, and online trading at a pace we haven’t seen elsewhere, and that positions the country as an increasingly important global financial center.

How are you tailoring your offerings, platforms, or services to better serve traders and investors in the UAE and the wider GCC region?

We’re building out our product range and services to reflect the regional demand for asset classes like gold, along with culturally aligned features such as Sharia-compliant accounts. We’ve also seen that mobile-first experiences, fast execution, and automation are priorities for traders here, so those are central to our platform development. On the service side, we’re looking to establish regional support functions to make sure our clients in the UAE and GCC are well served and engaged.

What major trends do you see shaping the future of online trading and fintech in the Middle East, and how is Scope Markets positioned to respond to them?

We’re seeing rapid growth in mobile-first fintech adoption, a strong push for automation, and increased regulatory clarity in areas like crypto. Traders are becoming more sophisticated and expect seamless user experiences, fast payments, and localized features. There’s also strong interest in diversification, particularly in gold, which continues to attract attention due to global uncertainty. We’re positioning ourselves to meet these needs through tech development, regulatory compliance, and regional product adaptation so we can evolve with the market.

What message would you like to share with your UAE-based clients and stakeholders about Scope Markets’ long-term plans in this market?

We’re here for the long term. We’re committed to being fully licensed, transparent, and responsive to the needs of traders in the UAE. This includes delivering regionally relevant products, building local infrastructure, and continuing to invest in the tools and technology that matter to our clients. Our aim is to support traders with a platform that’s reliable, compliant, and built around how people in this market want to trade.

Financial

Emerging Trends Shaping Financial Empowerment and Inclusion in the UAE Workforce

By Claudio Di Zanni, Managing Director, Edenred Middle East

One of the most critical issues faced by low-income employees across the UAE and the broader Gulf region is achieving true financial empowerment. In the UAE, over 60% of the workforce comprises low-income migrant workers earning less than AED 5,000 per month. These employees are the backbone of the nation’s key industries, yet many still struggle to access the benefits of a fully digital financial ecosystem.

While the UAE’s Wage Protection System (WPS) was introduced to safeguard workers’ rights—ensuring salaries are paid accurately, on time, and through traceable digital channels—the banking system’s minimum salary requirement prevents a large portion of the workforce from opening traditional accounts. This creates a structural gap that payroll solutions are designed to fill, enabling compliant salary payments and basic access to digital finance.

As the Middle East accelerates its digital transformation and workforce reforms, how workers are paid and supported financially has become as important as how they contribute to growth. This shift has put a renewed spotlight on the systems managing their wages and day-to-day financial needs. For low-income employees, these systems determine not just how they are paid, but how securely they live—affecting access to savings, remittances, and their ability to handle emergencies.

When Digital Pay Isn’t Enough

The introduction of the Wage Protection System marked a turning point in the UAE’s journey toward fair and transparent wage practices. Today, nearly all employees are paid through digital channels, ensuring salaries are disbursed accurately and on time. Yet despite these advances, a significant percentage of wages are still withdrawn in cash each month, showing that digital pay does not automatically translate into digital financial inclusion.

For many employees, limited digital literacy, mistrust of financial systems, and unfamiliarity with digital tools prevent them from engaging fully with the digital economy. As a result, the very system designed to protect and empower workers can feel more like a compliance obligation than an opportunity for empowerment.

This is where payroll providers play a critical role. Too often, the industry stops at compliance—ensuring wages are delivered digitally—without addressing the human factors that determine whether employees can truly benefit from financial technology. Empowerment comes not from the transfer itself, but from helping workers understand, trust, and use digital money confidently. Only then can payroll innovation translate into lasting financial well-being and equal access to economic opportunity across the UAE.

Digital salary management platforms have already transformed how employees receive and manage their earnings. Mobile apps and prepaid cards now give workers immediate access to their wages, allowing them to make purchases, send remittances, and track expenses in real time. Many solutions integrate seamlessly with the WPS, enabling even unbanked employees to participate in the digital economy for the first time. A recent study found that organizations implementing mobile-accessible payroll solutions report up to 25 percent higher employee satisfaction, underscoring the clear business value of digital inclusion.

Empowering Through Education

Financial literacy programs are equally critical in helping employees make informed decisions about saving, budgeting, credit, and long-term planning. In the UAE, less than 31 percent of the population demonstrates basic financial literacy, highlighting a major opportunity to empower workers through education.

From workshops to mobile-based learning tools, such programs can equip employees with the practical skills to use digital salary systems effectively, avoid debt traps, and build savings or plan remittances. Employers that distribute salary cards directly at worker accommodations and provide multilingual support during onboarding see much higher adoption rates, as these field-level activations build trust and make digital tools easier to use.

Employers who take financial education seriously often see a clear business impact. Companies that invest in onboarding sessions and field engagement consistently report higher digital adoption rates. These activations not only build trust but also transform digital payroll from a compliance task into a tangible employee benefit.

When workers understand and trust digital tools, they gain control over their finances—and that stability shows at work. Financial stress is one of the most common challenges among low-income employees, limiting their ability to manage urgent expenses and affecting productivity, retention, and overall well-being. In sectors such as construction, this stress can even impact concentration and safety, as employees distracted by financial worries are less able to perform at their best.

Partnerships between employers and fintechs like Edenred are expanding this approach, combining digital wage tools with financial education programs that improve confidence, satisfaction, and long-term well-being.

The Next Phase of Financial Empowerment

Employers remain central to driving inclusion. By choosing payroll partners that provide multilingual support, education, and easy mobile access, companies can reduce disputes, strengthen retention, and improve overall workforce stability.

A growing number of organizations are now exploring earned wage access programs, which allow employees to access a portion of their earned income before payday. Surveys show that most low-income workers value this flexibility to cover urgent expenses, medical bills, or family emergencies—without resorting to high-interest loans or informal borrowing. When paired with education and budgeting tools, earned wage access can provide not just relief in emergencies but also encourage more responsible money management.

This flexibility can increase employees’ sense of financial security, yet it should complement—not replace—broader financial literacy and planning initiatives. The most successful models combine accessible financial products, user education, and ongoing engagement, ensuring workers have both the tools and the confidence to manage their finances effectively.

As technology evolves, artificial intelligence and data analytics will make financial support more personalized and accessible. Predictive models can help employers identify employees under financial strain, while new digital products can guide users toward healthier financial behaviors. But technology alone will not close the gap.

Real progress will depend on collaboration between fintechs, employers, and regulators to build an ecosystem that blends technology, education, and empathy. Businesses increasingly recognize that supporting workers in their financial journeys fosters a more engaged and loyal workforce, directly impacting productivity and retention. Selecting payroll partners that combine compliance with education, multilingual support, and mobile accessibility helps companies reduce payroll disputes and improve satisfaction.

The trajectory of financial empowerment for low-income employees in the UAE is promising. The next stage will depend on how effectively stakeholders align innovation with understanding—ensuring every salary payment becomes an opportunity for inclusion and growth. When that happens, financial empowerment will move from aspiration to reality.

Financial

MultiBank Group and Khabib Nurmagomedov Launch an Exclusive Worldwide Multi-Billion-Dollar Joint Venture to Build the World’s First Regulated Tokenized Sports Ecosystem

Multibank Group, the financial derivatives institution, has entered into an exclusive worldwide multi-billion-dollar joint venture with global sports icon and undefeated UFC champion Khabib Nurmagomedov (29-0) to create a first-of-its-kind regulated ecosystem connecting global finance, sports and technology.

The partnership will culminate in the creation of a multi-billion-dollar joint venture, MultiBank Khabib LLC, uniting two global powerhouses: MultiBank Group, a leader in regulated financial excellence, and Khabib Nurmagomedov, undefeated in the octagon and whose influence extends far beyond sport. The company will operate from MultiBank Group’s headquarters in Dubai, building a worldwide network of high-end sports ventures and real-world digital assets. This structure fulfills the vision of MultiBank Group Founder and Chairman, Naser Taher, for an exclusive global joint venture, granting MultiBank exclusive rights to develop and promote projects under the Khabib Nurmagomedov brand name, including the development of 30 state of the art Khabib gyms, Gameplan and Eagle FC brands.

The entire venture is backed by MultiBank Group’s regulated digital ecosystem and powered by its cornerstone $MBG Token being the driving force behind its expanding portfolio of real-world-asset (RWA) technologies and initiatives.

Naser Taher, Founder and Chairman of MultiBank Group, stated: “From the UAE, we are shaping a new blueprint for the business of sport through the regulated tokenization of real-world sports assets (RWSA). Together with Khabib Nurmagomedov, and powered by our ecosystem token, $MBG, we are uniting finance and athletics into a single transparent, technology-driven ecosystem — one built on trust, innovation, and the strength of the MultiBank framework. This initiative proudly aligns with the UAE’s vision of becoming a global hub for digital asset innovation and world-class sports.”

Khabib Nurmagomedov added: “This partnership with MultiBank Group is built on shared values of strength, respect, and discipline. Together with Multibank, we are building real global opportunities that go beyond sport, empowering athletes, and fans through a regulated and innovative digital ecosystem. This is only the beginning.”

-

Tech News1 year ago

Tech News1 year agoDenodo Bolsters Executive Team by Hiring Christophe Culine as its Chief Revenue Officer

-

VAR7 months ago

VAR7 months agoMicrosoft Launches New Surface Copilot+ PCs for Business

-

Tech Interviews2 years ago

Tech Interviews2 years agoNavigating the Cybersecurity Landscape in Hybrid Work Environments

-

Tech News4 months ago

Tech News4 months agoNothing Launches flagship Nothing Phone (3) and Headphone (1) in theme with the Iconic Museum of the Future in Dubai

-

Tech News2 years ago

Tech News2 years agoBrighton College Abu Dhabi and Brighton College Al Ain Donate 954 IT Devices in Support of ‘Donate Your Own Device’ Campaign

-

Editorial11 months ago

Editorial11 months agoCelebrating UAE National Day: A Legacy of Leadership and Technological Innovation

-

VAR1 year ago

VAR1 year agoSamsung Galaxy Z Fold6 vs Google Pixel 9 Pro Fold: Clash Of The Folding Phenoms

-

Cover Story8 months ago

Cover Story8 months agoUnifonic Leading the Future of AI-Driven Customer Engagement