Automotive

Driving Change – Part 2: Media Perception

By Paige Lingwood, Insights Consultant, CARMA

The global automotive industry is undergoing a major transformation, sparked by geopolitical pressures, the rise of new Chinese competitors, supply chain vulnerabilities, and changing consumer preferences. This report analyzes online media responses to Chinese automotive brands and their impact on established global competitors throughout 2024.

Key Objectives

This analysis examines the tonality towards Chinese brands versus established brands, identifies positive and negative attributes, explores leading trends driving coverage peaks, and assesses confidence levels and skepticism in the industry’s transition.

Methodology

The study analyzed a representative sample of 12,000 articles from January 2024 to January 2025 across 15 markets including Brazil, China, France, Germany, Italy, Japan, Malaysia, Philippines, Saudi Arabia, Singapore, Spain, UAE, UK, and USA. Media outlets were selected based on automotive industry relevance, including specialist outlets, news sources, lifestyle media, and technology publications.

Industry Landscape

Chinese brands now dominate the global electric vehicle market, accounting for seven of the top 10 positions in global EV seller rankings. BYD stands out as the leading performer, with plug-in deliveries increasing 58.2% year-on-year, representing 26.1% of all EV sales in 2024. Despite this rise, established brands maintain command over global passenger car sales, with Tesla’s Model Y (1.09 million sales) and Toyota Corolla (1.08 million sales) leading 2024 sales.

Top Industry Trends for 2025

1. Tariffs Dominating Discussion

Tariffs emerged as a major issue in 2024, with the EU enforcing new import tariffs up to 45% on Chinese EVs in October. US tariffs on Chinese imports and President Trump’s reciprocal tariffs affecting over 180 countries continue driving media coverage. The “Detroit 3” (General Motors, Ford, Stellantis) face the most significant impact due to their North American operations.

2. Deeper Tech Collaboration

With Chinese brands driving rapid innovation, traditional automakers can no longer thrive independently. Notable collaborations include Toyota-Tencent, Renault-Cerence, Nissan-Baidu, Stellantis-Mistral, and Volkswagen-Horizon Robotics. These partnerships are evolving into deeper relationships, acquisitions, or mergers.

3. Autonomous Driving and Software-Defined Vehicles

By 2025, 60% of newly sold cars will feature autonomous driving capabilities like adaptive cruise control and lane-assist. Software-defined vehicles (SDVs) represent a seismic shift, with over-the-air updates and enhanced safety becoming major selling points.

4. New Audience Engagement

Brands adapt through influencer marketing and YouTube strategies, with 80% of car buyers influenced by YouTube content during their purchase process. The Consumer Electronics Show (CES) has emerged as a key automotive showcase, eclipsing traditional auto events.

5. TikTok’s Emerging Role

While TikTok accounts for just 4% of potential car buyers, brands focus on the platform for Gen Z influence. TikTok released new automotive advertising formats in February, positioning itself as a full-funnel platform for the industry.

Key Findings

Media Perception Alignment

Chinese brands receive characteristically low criticism and high positive coverage on crucial factors like pricing, technology, and reliability. This aligns with consumer research showing price, reliability, and technology as key purchase decision factors.

BYD’s Dominance

BYD leads share of voice with double the coverage volume compared to brands like Geely, Volkswagen, and BMW. The brand generates 41% of all positive Chinese brand coverage, with 37% of BYD’s coverage being positive versus 30% for Chinese brands overall and 24% for established brands.

Innovation Leadership

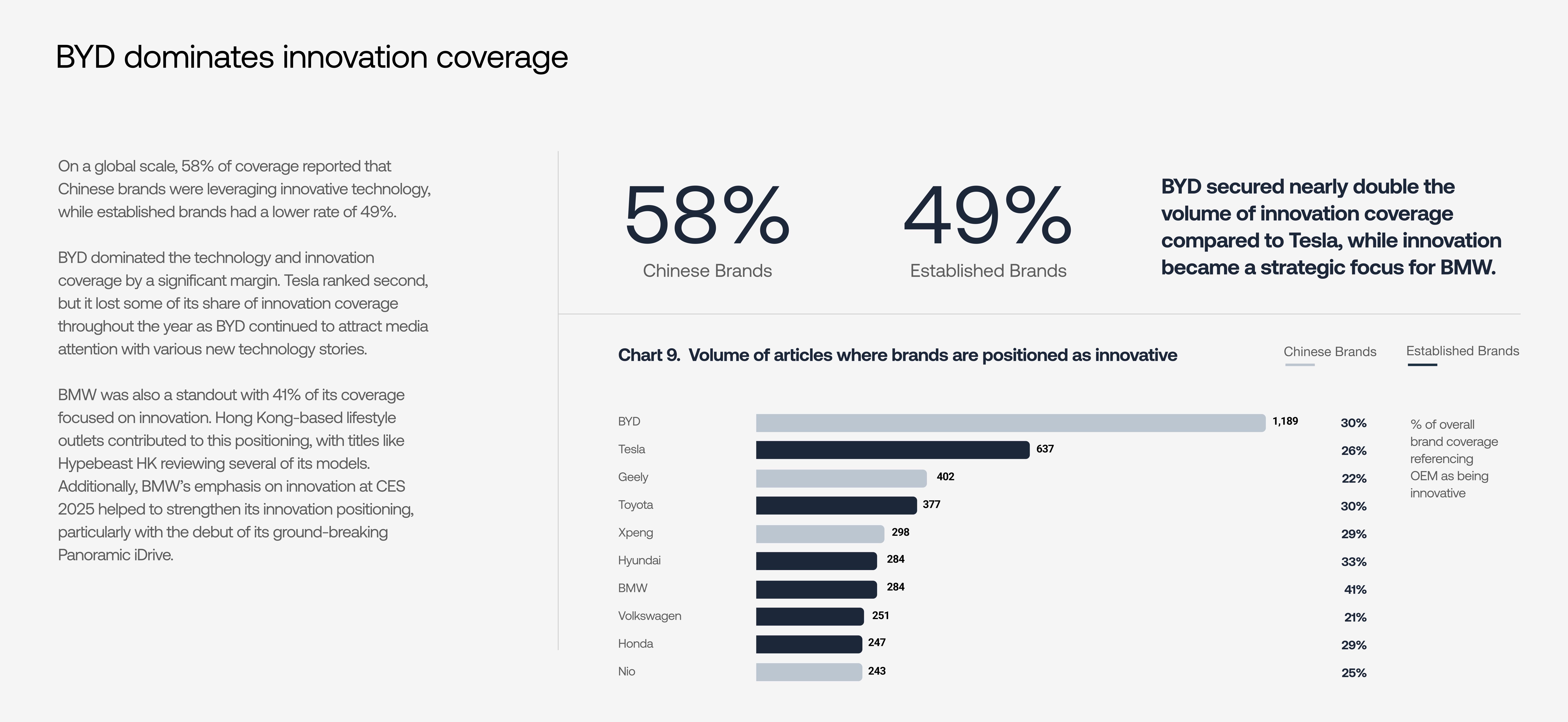

Close to 60% of media coverage reported Chinese brands utilizing innovative technology compared to 50% for established brands. UAE-based media contributed significantly to this positive technology focus, elevating Chinese brand perception in the Middle East.

High Confidence Levels

Media express high confidence and low skepticism toward Chinese brands overall. Brands like Haval, Wuling, Zeekr, and Chery showed the highest confidence proportions, while Chrysler, Volkswagen, SAIC, and Tesla received the most skeptical coverage.

Coverage Trends Throughout 2024

The period between April and May marked a turning point as Chinese brands gained higher share of voice for the first time. This trend reversed from September when established brands captured attention with financial results and forecast cuts.

Tariff discussion peaked mid-year as the US quadrupled charges for Chinese imports, with 25% of tariff coverage occurring in July alone. Battery Electric Vehicles dominated both media coverage and global EV sales, driven by debates on tariffs and pricing wars between Tesla and BYD.

Consumer Decision Factors

Price, reliability, and technology received positive Chinese brand coverage across multiple markets. Onboard technology emerged as a clear advantage, facing minimal criticism. The US Information Technology & Innovation Foundation reported Chinese EV brands are 30% faster at developing and launching new models compared to established brands.

BYD secured nearly double the innovation coverage volume compared to Tesla, while BMW achieved 41% innovation-focused coverage. Globally, 58% of Chinese brand coverage highlighted innovative technology versus 49% for established brands.

Media Confidence Analysis

Journalists globally express confidence toward Chinese brands’ future, with limited outright skepticism. BYD alone contributes 36% of overall Chinese brand confidence, while Tesla leads established brands with 11% confidence contribution.

The Philippines displayed highest confidence in Chinese brands, particularly GAC, while UK and Saudi Arabia contributed nearly 30% of global skepticism, primarily focused on tariff expansion impacts.

Conclusion

Chinese automotive brands, led by BYD, are successfully redefining industry dynamics through positive media positioning aligned with consumer preferences. The synergy between earned media coverage and consumer decision factors indicates a winning formula in the competitive landscape. As the industry continues evolving through technological advancement, regulatory changes, and shifting consumer behavior, the ability to adapt, collaborate, and connect with audiences will determine success.

The rise of Chinese brands represents more than market disruption—it signals a fundamental transformation in how automotive companies approach innovation, technology integration, and consumer engagement in an increasingly digital and environmentally conscious marketplace.

Automotive

Arabian Automobiles Introduces Choice-Led Nissan Ramadan Offers Reflecting the Spirit of the Holy Month

Arabian Automobiles Company (AAC), the flagship automotive company of AW Rostamani Group and the exclusive dealer for Nissan in Dubai, Sharjah, and the Northern Emirates, has launched its Nissan Ramadan offers across selected models. Aligned with the spirit of generosity associated with the Holy Month, the campaign is structured around flexibility and choice.

Customers can select one of three ownership options based on their priorities, whether that is added reassurance through complimentary insurance and service, greater ease in monthly planning with 0% interest rate over three to five years, or a savings option across selected models. Businesses, fleet owners and logistics operators can also benefit from these Ramadan offers, with value-led advantages such as 5-year warranty, 5-year service, and 5-year roadside assistance extending the same spirit of flexibility to commercial needs.

This approach reflects AAC’s considered interpretation of value, recognising that customer needs and circumstances differ, and that choice plays a central role in how value is defined during Ramadan.

The offers span a broad lineup, including Altima, Kicks, Magnite, Pathfinder, Patrol, X-TERRA, and X-TRAIL, with savings ranging from AED 6,000 up to AED 25,000. For those seeking a more performance-led experience, the Nissan Z is also included, also with savings of up to AED 50,000.

That same spirit of care continues beyond the showroom, with seasonal after-sales advantages. Customers coming in for an interval service or a free inspection will be eligible for a one-year, 24/7 roadside assistance membership covering Dubai, Sharjah, and the Northern Emirates.

Keeping convenience in mind, Arabian Automobiles is offering a buy-four-get-one promotion on maintenance contracts to make long-term upkeep more manageable, alongside up to 65% off parts for additional repairs. Flexible payment options are available through Tabby and selected credit card plans, and a gift is included with any Nissan accessory purchase. Customers are invited to explore the Ramadan campaign at their nearest Nissan of Arabian Automobiles showroom.

Automotive

UDRIVE PARTNERS WITH AGMC TO INTRODUCE MINI VEHICLES TO ITS CAR-SHARING FLEET IN THE UAE

Udrive, the UAE’s leading car-sharing platform, has signed a strategic partnership with AGMC, the official importer of MINI in Dubai, Sharjah and the Northern Emirates, to introduce MINI vehicles to Udrive’s shared mobility fleet in the UAE. The collaboration was formalised through a Memorandum of Understanding (MoU) between Udrive and AGMC and brings the MINI brand — the iconic British-heritage premium automotive brand within the BMW Group, renowned for its distinctive design and engaging driving experience — into the car-sharing space, supporting a shared ambition to expand access to premium urban mobility solutions across the country.

The partnership will see a total of 100 MINI vehicles progressively introduced to the Udrive platform, with an initial fleet already available to customers across the UAE. The lineup will include MINI Convertibles, bringing the experience of open-top driving into the car-sharing space, alongside other MINI models well-suited to urban mobility and everyday city use. Through the Udrive platform, customers benefit from an all-inclusive car-sharing experience, with fuel and parking covered as part of the service.

By expanding flexible access to premium mobility, the partnership supports the UAE’s broader ambitions for smarter, more connected cities, in line with the vision outlined in the Dubai Master Urban Plan 2040. The collaboration reflects a growing shift toward agile, shared and experience-led mobility solutions, complementing evolving urban lifestyles and mobility needs.

Hasib Khan, Founder and CEO of Udrive, said: “At Udrive, innovation is about giving customers real choice and flexibility. Our platform is designed to adapt to how people live, whether that means enjoying a convertible over the weekend or choosing a practical vehicle during the week. Partnering with AGMC MINI allows us to bring distinctive premium vehicles to more customers and support the UAE’s vision for flexible and efficient urban mobility.”

Ziad Boghdady, Head of AGMC MINI, said: “Our collaboration with Udrive introduces a new way for customers to experience the MINI brand. Integrating MINI models into a car-sharing platform reflects changing preferences in the UAE, where access and flexibility are increasingly valued alongside design and performance, complementing MINI’s distinctive design and engaging driving experience. The partnership demonstrates AGMC MINI’s commitment to supporting modern mobility solutions that fit the needs of today’s urban lifestyles.”

Through the MoU, users will gain access to a range of MINI models via the Udrive platform, including Cooper S and John Cooper Works variants, as well as MINI Convertibles. Introducing convertibles into the car-sharing space expands the scope of shared mobility experiences, offering customers the opportunity to enjoy open-top driving on a flexible, on-demand basis.

Udrive enables customers to locate, book, and unlock vehicles through its mobile app, with flexible by-the-minute or by-the-day rentals. The service includes free fuel, free parking, and no deposit, removing common barriers associated with traditional car rentals. Udrive now operates a fleet of 2,000+ cars and has completed over three million rentals to date. In 2025 alone, the platform recorded over 554,000 trips and more than 45 million kilometres driven, reflecting growing demand for flexible mobility across the UAE.

Udrive continues to differentiate itself through exclusive partnerships, first-to-market initiatives, and value-led offerings that expand customer choice. Promoting car sharing as an alternative to private car ownership helps optimise vehicle usage, reduce congestion, and lower the overall environmental footprint by encouraging shared access over individual ownership.

Automotive

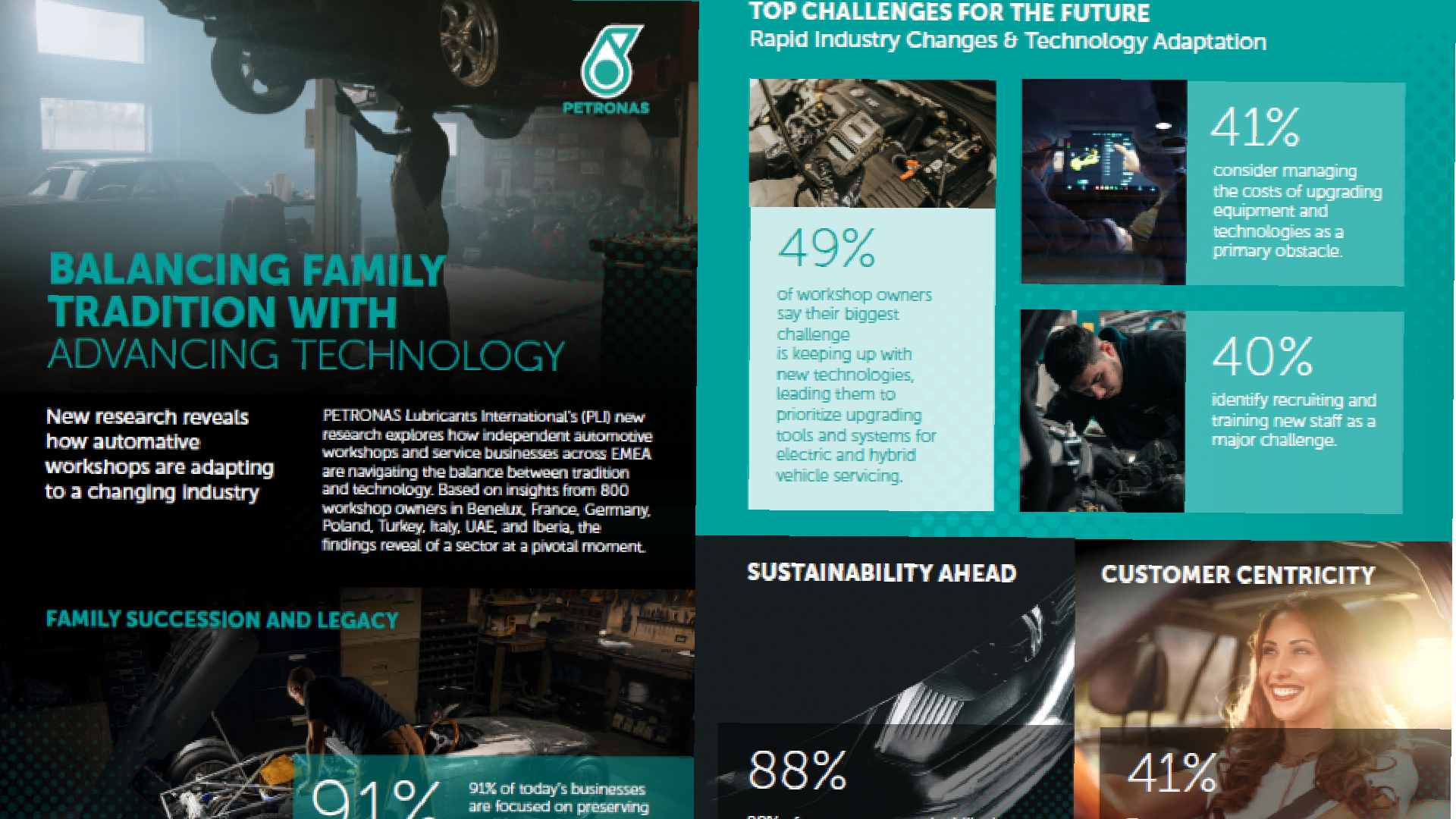

BALANCING TRADITION AND TECHNOLOGY: THE NEXT GENERATION TRANSFORMING AUTOMOTIVE WORKSHOPS

PETRONAS Lubricants International (PLI) today unveils new research exploring how independent automotive workshops and service businesses across EMEA are navigating the balance between tradition and technology. Based on insights from 800 workshop owners in Benelux, France, Germany, Poland, Turkey, Italy, the UAE, and Iberia, the findings reveal the sector is at a pivotal moment.

Nearly all workshop owners believe that protecting their reputation and values, as part of a family or community tradition, is paramount. This sense of legacy is particularly strong in Turkey (96%), the UAE (96%), and Iberia (95%.) The findings reveal a deep emotional connection among the next generation and new mechanics entering the industry, who are committed to preserving the skills and standards of their predecessors. Whilst at the same time, demonstrating the powerful blend of tradition and innovation which drives the sector.

The research, commissioned by PLI, reveals that owners are also acutely aware of the need to stay up to date with today’s technological advancements. This is where the energy and talent of younger generations become truly invaluable. Their passion for innovation and natural fluency with digital tools can transform what might seem like a challenge into an exciting new chapter for the industry. By actively investing in young talent and embracing their fresh perspectives, workshops can become vibrant hubs of progress, bridging digital and technological gaps, and leading the way in both the digital and green transitions shaping the automotive sector.

Nearly three in five (59%) owners report their workshop is seen as a trusted service provider locally but tradition alone isn’t enough to secure the future. With the industry changing fast, almost half (49%) of workshop owners say their biggest challenge is keeping up with new technologies. From electric and hybrid vehicles to digital systems and advanced diagnostics, the pressure to modernize is real. It’s also compounded by the struggle to find and train skilled staff, an issue flagged by nearly half of respondents (40%). For younger professionals entering the industry, this gap represents an opportunity to carve out a future in a sector hungry for fresh talent and innovation. Embracing the tech savviness and adaptability of younger workshop owners not only bridges existing gaps but also opens doors for further training and job opportunities, empowering workshops to evolve, driving a better future for all.

Despite the challenges of staffing, there’s a strong sense of optimism in the sector. Owners are determined to blend the best of the past with the demands of the future. More than a third (35%) say that putting the customer first remains their top priority, even as they navigate new territory. They’re finding ways to balance tradition with innovation, ensuring their workshops stay relevant and resilient.

“Independent workshops are the backbone of the automotive industry, and their ability to evolve by bringing in younger generations is inspiring. The research that PLI has commissioned shows that while heritage and trust remain at the heart of these businesses, owners are embracing innovation, from electric vehicles to digital tools and sustainable practices. At PLI, we’re committed to supporting this transformation by providing solutions that help workshops stay competitive, relevant, and true to their values.” said Giuseppe Pedretti, Regional Managing Director EMEA, PETRONAS Lubricants International

Sustainability is a defining theme for the sector, with nearly nine in ten (88%) workshop owners considering it essential in daily operations and customer communications. As consumers become more environmentally conscious, integrating sustainable practices is crucial for long-term growth, reputation, and alignment with global goals. Accelerating this transition requires investing in younger workshop owners, who bring fresh perspectives, digital expertise, and enthusiasm for innovation, supported by targeted training.

Empowering the next generation goes beyond adapting to change; it ignites a shared passion for the future and ensures workshops remain central to a dynamic, evolving industry. As the automotive landscape transforms, PLI stands as a trusted partner, offering solutions that reflect the values and ambitions of both established owners and emerging talent, driving real-world success.

-

Tech News2 years ago

Tech News2 years agoDenodo Bolsters Executive Team by Hiring Christophe Culine as its Chief Revenue Officer

-

News10 years ago

SENDQUICK (TALARIAX) INTRODUCES SQOOPE – THE BREAKTHROUGH IN MOBILE MESSAGING

-

VAR11 months ago

VAR11 months agoMicrosoft Launches New Surface Copilot+ PCs for Business

-

Tech Interviews2 years ago

Tech Interviews2 years agoNavigating the Cybersecurity Landscape in Hybrid Work Environments

-

Tech News8 months ago

Tech News8 months agoNothing Launches flagship Nothing Phone (3) and Headphone (1) in theme with the Iconic Museum of the Future in Dubai

-

Automotive1 year ago

Automotive1 year agoAGMC Launches the RIDDARA RD6 High Performance Fully Electric 4×4 Pickup

-

VAR2 years ago

VAR2 years agoSamsung Galaxy Z Fold6 vs Google Pixel 9 Pro Fold: Clash Of The Folding Phenoms

-

Tech News2 years ago

Tech News2 years agoBrighton College Abu Dhabi and Brighton College Al Ain Donate 954 IT Devices in Support of ‘Donate Your Own Device’ Campaign